Are AI stocks losing ground? A recent report from Morgan Stanley suggests that that might be the case, as a recent note suggested AI stocks are in “later innings.” The Morgan Stanley analysis uses Nvidia as a proxy for the AI stock market in general, and suggests that the run-up that’s happened for Nvidia might be mirroring the broader AI stock field.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The report came from Morgan Stanley analyst Edward Stanley, backed up by a team of expert strategists who suggest that there may be trouble ahead in AI stocks. Using Nvidia (NASDAQ:NVDA) as a proxy for the broader AI market, Stanley’s analysis suggests that the market may be running out of steam. Indeed, with Nvidia and other major AI-related tech firms like Intel (NASDAQ:INTC) and AMD (NASDAQ:AMD), performance has been phenomenal. Stanley describes gains of over 200% on a year-to-date basis. And since bubble peaks, Stanley describes, tend to run around 150%, this bubble would be more pronounced and possibly reaching its end game.

Indeed, there are some issues coming up with AI that may put some brakes on the matter. The Washington Post detailed a set of experiences that illustrate how AI may have an infatuation with anorexia, providing a series of how-tos couched with disclaimers and “thinspirational” content of disturbingly slender people. Microsoft (NASDAQ:MSFT), meanwhile, came out to declare that AI contributes would prove “gradual.” Even AMD noted that AI accelerators would be a $150 billion market…by 2027.

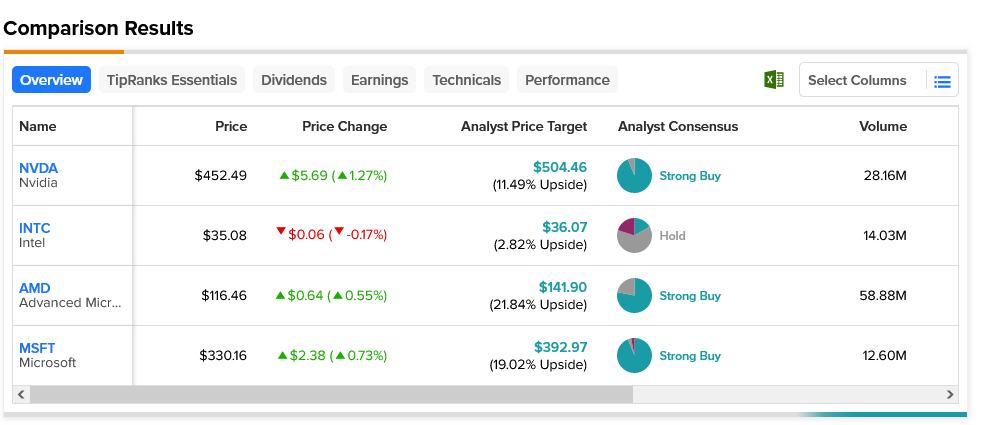

Interestingly, of the four stocks referenced, only Intel took a hit today. The other three were up, in varying amounts; Microsoft and AMD were up fractionally while Nvidia had modest gains. Of particular note, only Intel is rated a Hold by analyst consensus. The other three are Strong Buys. Further, among the Strong Buys, upside potential is comparable. AMD has the strongest upside at 21.84% on an average price target of $36.07. Meanwhile, Intel’s upside is only 2.82% on its $36.07 average price target.