Take-Two (TTWO) stock was up on Monday as analysts updated their coverage of the company following its latest earnings report. As a reminder, the video game publisher posted adjusted earnings per share of $1.07 on revenue of $1.58 billion, compared to Wall Street’s estimates of $1.10 per share and $1.55 billion in revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite those mixed results, analysts remain bullish on TTWO stock.

- Morgan Stanley analyst Matthew Cost maintained an Overweight rating and increased his price target to $265 from $210, representing a possible 13.35% upside for the company’s shares.

- UBS analyst Chris Schoell kept a Buy rating for TTWO stock and increased the price target to $275 from $230, a potential 17.63% upside.

- Five-star Roth MKM analyst Eric Handler reiterated a Buy rating and $265 price target, implying a 13.35% upside for the shares.

Analysts remain bullish on Take-Two stock as the company gears up to release Grand Theft Auto VI on May 26, 2026. This could be a huge catalyst for TTWO shares as its predecessor, Grand Theft Auto V, is the second-best-selling game in history with over 215 million units shipped. Even a fraction of those sales could be a huge win for Take-Two and its investors.

TTWO Stock Movement Today

While Take-Two had to delay Grand Theft Auto VI to 2026, and its latest earnings were mixed, TTWO stock has remained a strong investment in 2025. The company’s stock jumped 3.05% on Monday morning, and has rallied 26.93% year-to-date.

Is TTWO Stock a Buy, Sell, or Hold?

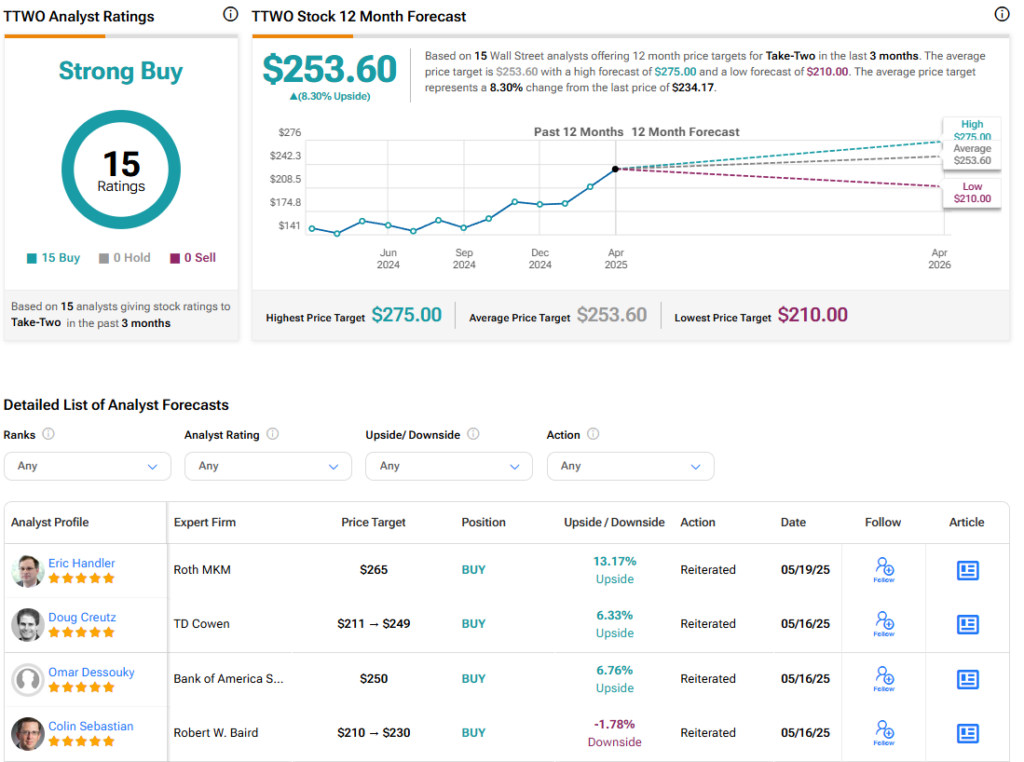

Turning to Wall Street, the analysts’ consensus rating for Take-Two is Strong Buy, based on 15 Buy ratings over the last three months. With that comes an average TTWO stock price target of $253.60, representing a potential 8.3% upside for the shares.