Sandwich chain Subway has finally found a buyer, implying its months-long sale process could finally be coming to an end. The private equity firm Roark Capital could snap up Subway for $9.6 billion, the Wall Street Journal reported.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The leading quick-service restaurant brand engaged advisers to explore a potential sale at the beginning of 2023. However, it struggled to find the right deal (Subway was seeking $10 billion) as macro uncertainty and higher interest rates made leveraged buyouts challenging.

Per the report, Roark Capital, which also owns Arby’s and Baskin-Robbins brands, could finalize a deal as soon as this week. Nevertheless, Roark faces competition from a rival private equity group, including TDR and Sycamore, as they could come up with a higher bid.

It remains to be seen whether Roark Capital manages to clinch a deal. Meanwhile, Subway continues to deliver strong performance with positive global sales and higher average unit volumes. Let’s delve into its performance.

Subway Delivers 10 Consecutive Quarters of Positive Sales

The sandwich chain is in the middle of a multi-year transformation aimed at accelerating sales and driving efficiency. Its transformation plan is working well, as Subway achieved 10 consecutive quarters of positive sales despite macro challenges.

In July, the company said it achieved its highest average unit volume in North America for three consecutive months. As for the first half of 2023, Subway delivered a 9.8% increase in same-store sales and 11.1% growth in digital sales. During the same period, its same-store sales rose 9.3% in North America, while digital sales improved by 17.8%.

Subway said that menu innovation, ongoing improvements to the overall guest experience, and the modernization of restaurants continue to drive traffic and sales. On the other hand, it faces tough competition from other quick-service restaurant brands like McDonald’s (NYSE:MCD), which has also delivered stellar same-store sales growth globally in the first half of 2023. With about 40,000 locations in more than 100 countries, McDonald’s is among the largest restaurant brands globally. In comparison, Subway has approximately 37,000 restaurants around the world.

While Subway is privately held, let’s consider what the Street recommends for MCD stock.

Is McDonald’s a Good Stock to Buy?

Wall Street analysts are bullish about iMCD’s prospects thanks to its stellar comparable sales growth and strong earnings.

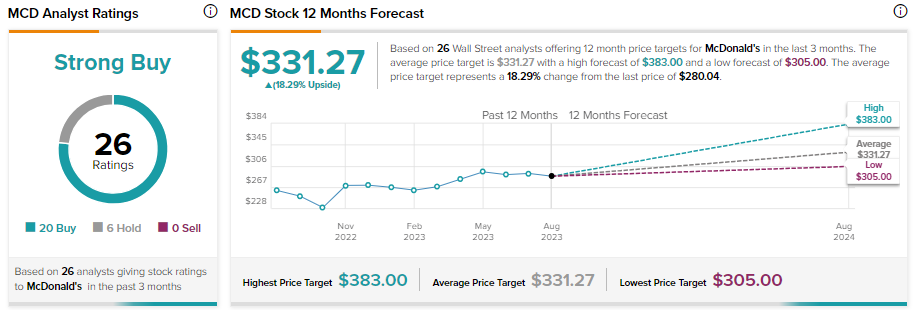

With 20 Buy and six Hold recommendations, McDonald’s stock has a Strong Buy consensus rating. Meanwhile, analysts’ average price target of $331.27 implies 18.29% upside potential from current levels.