American snacks and beverage giant PepsiCo is scheduled to report its Q3 earnings before the market opens on Thursday, October 9.

Is PepsiCo (PEP) a Good Stock to Buy Ahead of Q3 Earnings?

Story Highlights

As PepsiCo (PEP) gears up to report its Q3 2025 earnings on October 9, investors are wondering whether now is the right time to buy the stock. The company, known for its iconic snack and beverage brands, is often viewed as a stable, defensive investment. However, rising costs, changing consumer habits, and recent guidance cuts have added some uncertainty.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts expect PepsiCo to post slightly lower earnings year-over-year, despite higher revenues for the quarter ending September 2025. The stock could see a boost if these key numbers beat market expectations in the upcoming earnings release.

What to Expect from PepsiCo’s Q3 Earnings

Wall Street analysts expect PepsiCo to report Q3 earnings per share (EPS) of $2.26, slightly below the $2.31 posted in the same quarter last year. Meanwhile, revenue is projected to be $23.86 billion, within a range of $23.65 billion to $24.18 billion, according to PepsiCo’s analyst forecasts page on TipRanks.

For the full year, the company expects flat core earnings (at constant currency) and low-single-digit growth in organic revenue.

What’s Happening with PEP Stock?

PEP stock has recently attracted increased attention after activist investor Elliott Investment Management disclosed a $4 billion stake in the company. Elliott’s plan aims to review PepsiCo Beverages North America, restructure its foods division, boost growth, and improve accountability, potentially lifting the stock over 50%. The screenshot below shows PepsiCo’s revenue breakdown across different segments over the past few quarters.

With Q3 earnings approaching, investors will closely watch how management responds to activist pressure and advances in reshaping the company’s growth strategy.

Analysts’ View on PEP Stock

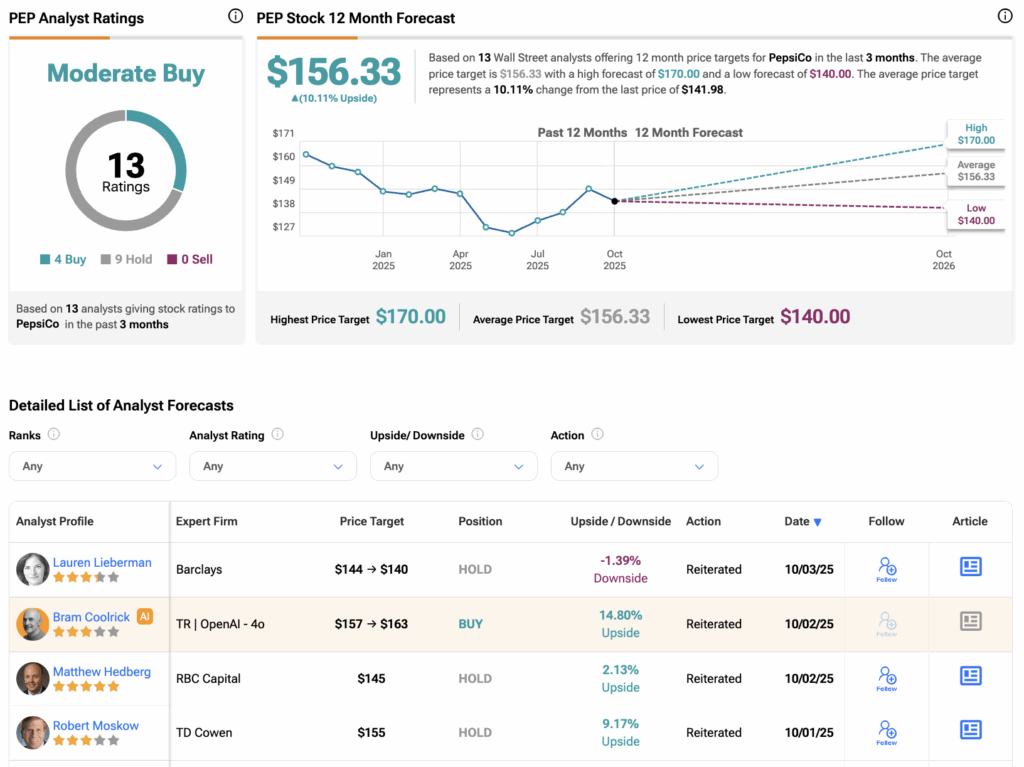

Ahead of Q3 earnings, Barclays analyst Lauren Lieberman maintained a Hold rating on PEP and lowered her price target from $144 to $140. Lieberman has a slightly more cautious view on sales and margins for PepsiCo’s upcoming quarter compared with the consensus.

On the other hand, UBS still lists it as a top consumer stock pick, expecting earnings growth and a higher valuation starting in 2026. Last month, UBS analyst Peter Grom maintained a Buy on PEP stock, predicting an upside of almost 20% from current levels. Grom highlighted some near-term challenges for PepsiCo, including sluggish trends in the U.S. market and weakness in key international regions expected in Q3. However, he noted that these issues are already well known to investors.

Is PepsiCo a Good Stock to Buy?

Turning to Wall Street, analysts have a Moderate consensus rating on PEP stock based on four Buys and nine Holds assigned in the past three months. At $156.33, the average PEP price target implies a 10.1% upside potential.

Year-to-date, PEP stock has declined by 6.63%.

1