Software company Okta (OKTA) is set to report its Fiscal Q1 2026 earnings after the market closes on Tuesday, May 27, 2025. Analysts expect earnings per share to come in at $0.77, with estimates ranging from $0.72 to $0.84. In addition, revenue is expected to be 680.28 million. In the previous year’s quarter, Okta reported EPS of $0.65 on revenue of $617 million, which were both better than expected. It is worth noting that investors will be closely watching remaining performance obligations (RPO) and current RPO (cRPO), which grew by 25% and 15% year-over-year, respectively, in Q4 FY 2025.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Okta’s recent success is thanks to its focus on identity governance and access management, with new products contributing to over 20% of Q4 bookings. The company has also seen significant growth through its partnership with AWS Marketplace by surpassing $1 billion in aggregate total contract value. Interestingly, revenue from this channel grew by more than 80% in FY 2025. Okta has also recently focused on improving how its products work together in order to offer a more unified identity platform, which could lead to more upselling opportunities.

Furthermore, investors will be monitoring for updates on how well Okta is doing with large enterprise clients, and whether slower IT spending or shifts in security budgets are hurting demand. Since Okta’s stock is still far below its previous highs, strong results, especially better-than-expected profit margins or subscription growth, could push the stock higher. This is because subscriptions make up the bulk of its revenue, as per the image below from Main Street Data. On the other hand, if the company gives weak guidance or misses expectations, it could renew worries about slower growth.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a 12% price move in either direction. This estimate is derived from the $124 strike price, with call options priced at $7.50 and put options at $7.46.

Is OKTA Stock a Buy, Sell, or Hold?

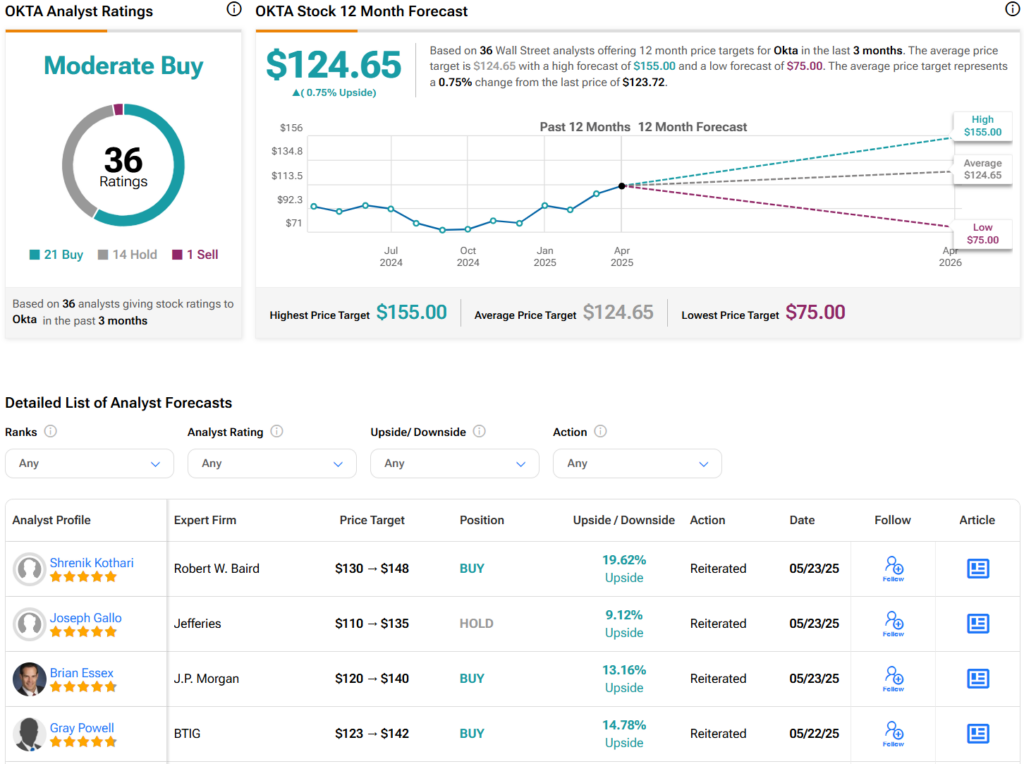

Overall, analysts have a Moderate Buy consensus rating on OKTA stock based on 21 Buys, 14 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average OKTA price target of $124.65 per share implies 0.8% upside potential.