Nuclear power technology company Oklo Inc. (OKLO) is set to release its first-quarter 2025 financial results after market close on Tuesday, May 13, 2025. Analysts expect an earnings per share (EPS) loss of $0.11 for the quarter, significantly improving from the $4.79 loss reported in the same period last year. While the company remains unprofitable, investor interest has risen, fueled by Oklo’s advanced nuclear reactor technology and its potential role in powering large-scale AI infrastructure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite near-term losses, sentiment around the stock remains cautiously optimistic. Some analysts view current market volatility and the roughly 50% pullback from its February highs as a potential long-term buying opportunity ahead of Q1 results.

What Investors Need to Watch

During the first quarter, Oklo signed several landmark agreements and completed the acquisition of Atomic Alchemy. With the nuclear fuel sector attracting increased funding in recent months, these developments may have positioned Oklo to benefit from rising industry momentum. Investors can expect further business updates to accompany the Q1 earnings release.

However, Oklo has yet to generate revenue. As a result, its ongoing operating expenses, largely tied to the development of its next-generation Aurora powerhouses, will continue to weigh on its bottom line, likely leading to another quarterly loss.

Additionally, the company’s first Aurora powerhouse is not expected to be deployed until 2027, signaling limited top-line performance in the near term. Notably, the Aurora microreactor is designed to produce 15 megawatts of electricity (MWe), with the potential to scale up to 50 MWe and operate continuously for over a decade without refueling. This underscores its long-term commercial promise.

Insights from TipRanks’ Bulls Say, Bears Say

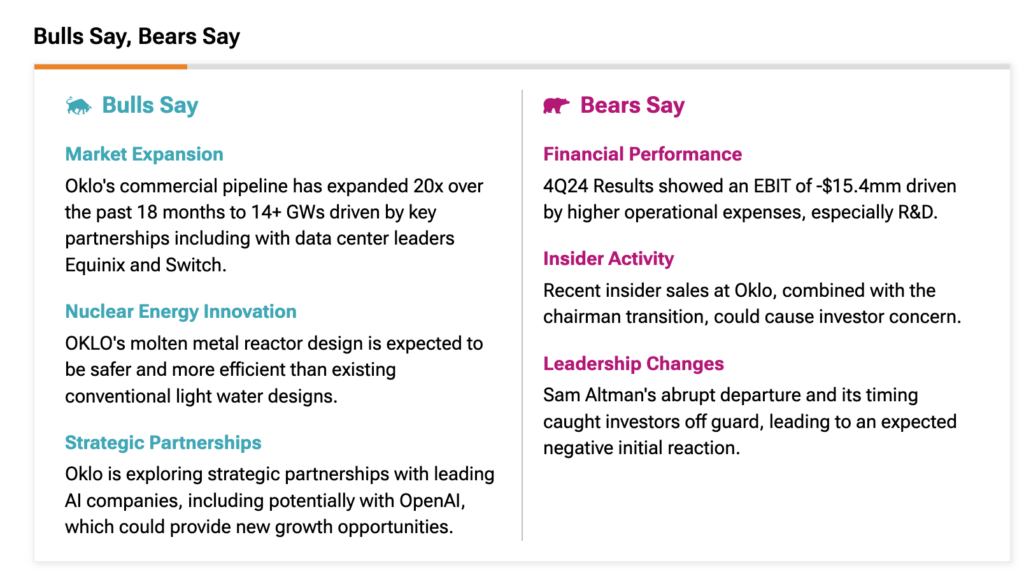

Investors can utilize TipRanks’ “Bulls Say, Bears Say” tool to gain insights into the contrasting analysts’ views on Oklo’s stock.

According to bullish analysts, Oklo presents a compelling long-term growth story, driven by a 20-fold expansion in its commercial pipeline to over 14 GW. Additionally, potential collaborations with leading AI companies could unlock significant new market opportunities and further strengthen its commercial trajectory.

On the other hand, bears are concerned about the company’s financial losses, primarily due to rising operational and R&D expenses. Additionally, recent insider selling and a sudden leadership transition, including OpenAI’s Sam Altman’s abrupt departure, have raised concerns about internal stability and strategic direction.

Is OKLO a Good Stock to Buy?

Overall, Wall Street has a Moderate Buy consensus rating on OKLO stock, based on four Buys and two Holds assigned in the last three months. The average Oklo share price target is $47.0, which implies an upside of 67.3% from current levels.