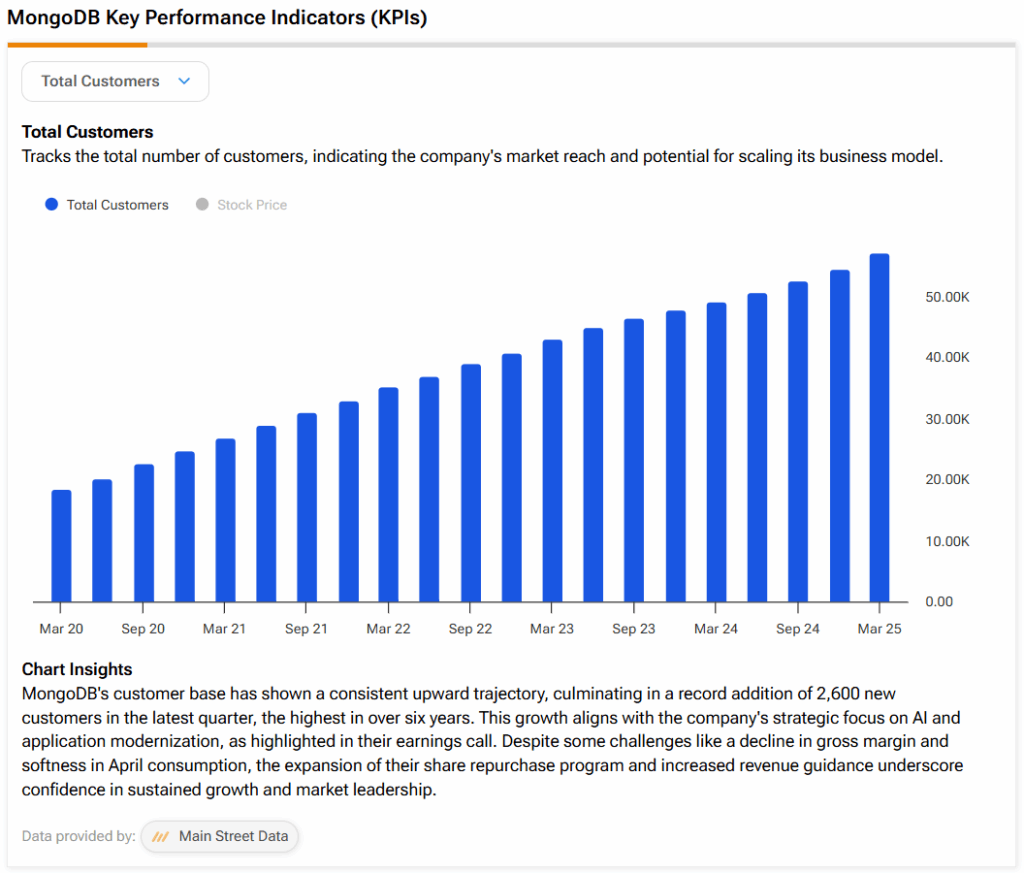

Software company MongoDB (MDB) is set to report its Q2 earnings results on August 26 after the market closes. Analysts are expecting earnings per share to come in at $0.67 on revenue of $553.93 million. This equates to a decrease in EPS from $0.70 but an increase in revenue from $478.11 million on a year-over-year basis. However, it’s worth noting that MDB has been beating earnings estimates for years now, and often by wide margins, as its customer count continues to grow steadily each quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

And there are reasons to believe that this streak will continue. Indeed, Citi, led by four-star analyst Tyler Radke, recently increased its price target for MongoDB from $395 to $405 and maintained its Buy rating. The firm also placed MongoDB on a “90-day positive catalyst watch” due to its belief that MongoDB is positioned to benefit more from artificial intelligence than investors currently assume. As a result, this implies that Citi expects earnings results to come in higher than anticipated.

At the same time, five-star analyst Brian White from Monness also kept a Buy rating on MongoDB, with a price target of $295. He pointed to MongoDB’s strong growth potential in cloud computing, the database market, and generative AI, despite economic challenges and stiff competition. It is also worth noting that the company’s second-quarter revenue is expected to rise due to the success of its Atlas service. In addition, MongoDB’s acquisition of Voyage AI and its large customer base further strengthens its position. Therefore, White believes that the firm could outperform its 2026 sales and earnings goals.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a large 15.9% price move in either direction. This estimate is derived from the $217.50 strike price, with call options priced at $17.10 and put options at $17.70.

Is MDB Stock a Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MDB stock based on 24 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average MDB price target of $273.10 per share implies 25% upside potential. Meanwhile, TipRanks’ AI analyst has an Outperform rating with a $243 price target.