It has been a solid year thus far for Lyft (NASDAQ:LYFT), as the ridesharing company has been gaining steam throughout 2025.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s Q2 2025 numbers reflected strong growth, with a record gross bookings figure of $4.5 billion, an increase of 12% year-over-year. Meanwhile, LYFT’s net income of $40.3 million compared quite favorably with $5.0 million in Q2 2024.

There were other operational highlights coming out of Q2 as well, as the company has inked partnerships with Baidu and United Airlines, among others, while also deepening its engagement with Alaska Airlines, Chase, and DoorDash.

The company also enjoyed strong growth with arguably its most basic metric – rides – which increased by 14% year-over-year to reach 234.8 million. Not only was this an all-time high, but it represented LYFT’s ninth straight quarter of double-digit, year-over-year growth.

Reflecting this strong performance, LYFT’s share price has lifted upwards by over 50% since the beginning of the year.

Still, some are worried that there is an expiration date on Lyft’s business model, as the advent of autonomous rides threatens its growth cadence. Not so fast, says investor Jon Quast, who believes that Lyft is “a key player for growth portfolios.”

“I see a golden opportunity as a company with the following features: its profits are improving; its stock trades at a cheap valuation; and it’s growing nicely. Lyft shows all three,” explains the 5-star investor.

Quast notes that LYFT will likely continue to experience strong growth. While overall growth in rides grew by 14%, the company is performing even better in “underpenetrated” geographies such as Nashville, where it grew by more than 20%.

The investor understands the concerns about autonomous driving, but he is quick to point out the holes in this bearish argument. For one, autonomous taxis aren’t exactly going to replace ridesharing in the near future, giving LYFT plenty of time to reap the spoils of its current setup.

Moreover, the investor posits that it is far from a given that self-driving will make LYFT a relic of the past, as the company could very well adapt to this brave new world (similar to Domino’s Pizza partnering with DoorDash).

“I believe that investors are overemphasizing the potential risks to Lyft’s business and underappreciating the investment opportunity,” sums up Quast. (To watch Jon Quast’s track record, click here)

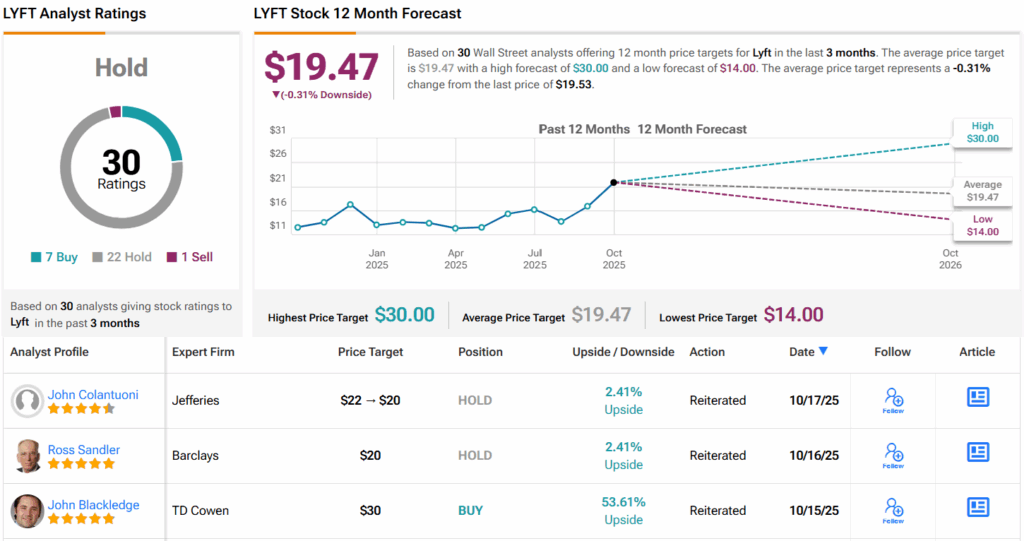

Wall Street isn’t quite ready to hail this ride, however. With 22 Holds far outpacing 7 Buys and 1 Sell, LYFT carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $19.47 implies minimal movement up ahead. (See LYFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.