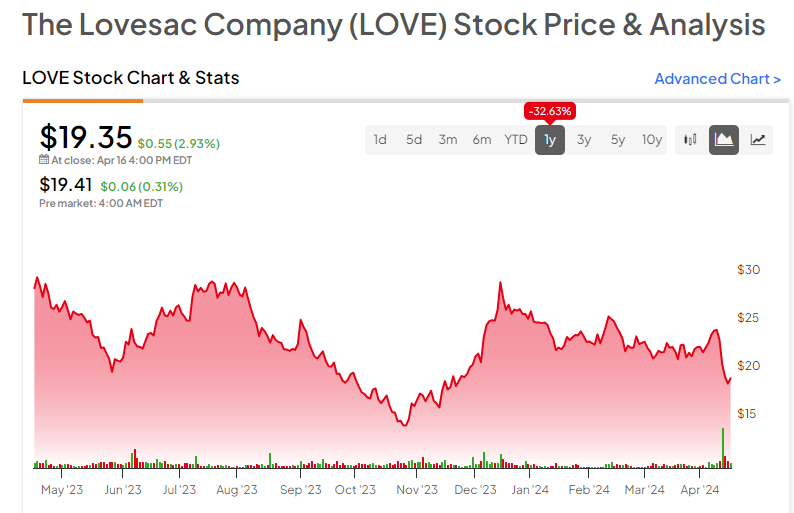

The Lovesac Company (NASDAQ:LOVE) has experienced its share of challenges, and the stock has shed a third of its value over the past year. However, the slide in the stock is likely overdone, as the company is poised to participate in a rebound in the furniture market. LOVE’s current levels could be an intriguing value play for investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the COVID-19 pandemic, the furniture market experienced considerable shifts in consumer behavior and manufacturing trends. Financial constraints led to decreased consumer spending on non-essential items such as home interiors, causing a decline in residential furniture demand. The market is slowly recovering, with consumers showing a willingness to spend on household items. The potential increase in furniture demand could benefit companies like The Lovesac Company.

A Lovesac Story

Lovesac is a direct-to-consumer specialty furniture brand that supports its e-commerce delivery model through 230 retail showrooms. The company was named after its original product, Durafoam-filled beanbags, known as ‘Sacs.’ The majority of its current sales are generated from a proprietary platform called Sactionals, a large upholstered seating solution that is washable, changeable, reconfigurable, and can be shipped via FedEx.

The company’s “Designed for Life” philosophy centers around sustainable products created to evolve with customers’ needs and last a lifetime. The aim is to provide long-term utility, while and drastically reducing the quantity of furniture ending up in landfills. This resonates with younger, more eco-conscious buyers.

Currently, Lovesac captures a small portion of this substantial market, representing a significant opportunity for growth and expansion. The market is poised for growth, with furniture expenditures projected to grow annually by 4.96% through 2025, rising from $148.4 billion to $189 billion.

LOVE’s Recent Financial Results & Outlook

For the fourth quarter ending February 2024, the company reported a net sales increase of 5.0% to $250.5 million. Net income for this period was $31.0 million, or $1.87 net income per diluted share. This is an increase from the prior year’s period of $26.2 million or $1.65 per diluted share, though short of analysts’ expectations for $265.4 million and $1.93 per share.

For the Fiscal year 2024, the company surpassed $700 million in revenues, a net sales increase of $49.1 million, or 7.5%. This achievement comes despite another year of significant category decline for the home furnishing sector. The company finished the quarter with a cash and cash equivalents balance of $87.0 million, with no balance on its line of credit.

Looking ahead to the full fiscal year 2025, the company forecasts net sales to be between $700 million and $770 million, which is in line with the consensus of $765.38 million. However, the expected net income is set to fall between $18 million and $27 million, translating to a diluted income per common share between $1.06 and $1.59, well below the consensus expectation of $2.15.

What is the Price Target for LOVE Stock?

The stock has been trending downward over the past year, punctuated by a 20% drop after the most recent earnings announcement, and it trades in the lower half of its 52-week price range of $14.18-$29.81. The price drop has pushed the stock into value territory based on comparative metrics, such as the company’s P/E ratio of 13.19x sitting below the Consumer Cyclical sector average of 18x and the Furnishings, Fixtures & Appliances industry average of 14.7x.

A significant short interest of 26.88% of outstanding shares suggests a strong bearish market sentiment. However, those shorts could act as fuel, pushing the stock higher if the company can surprise to the upside on upcoming earnings.

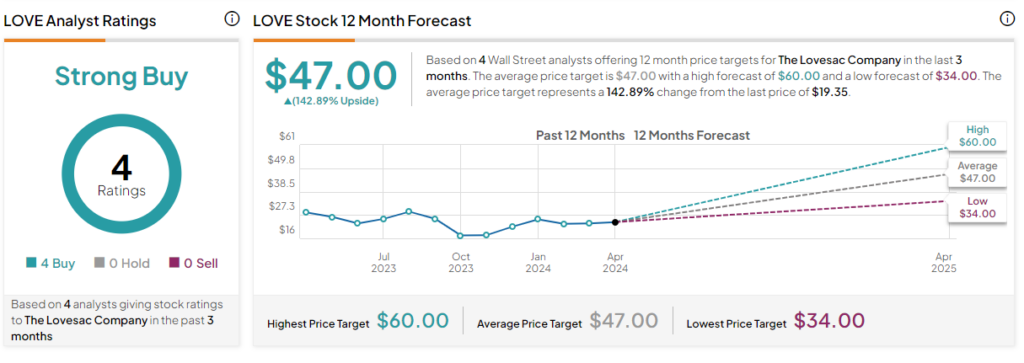

Analysts following the company have been mostly bullish. The stock is rated a Strong Buy based on the recommendations and 12-month price targets four Wall Street analysts issued over the past three months. The average price target for LOVE stock is $47.00, which represents over a 140% upside from current levels.

The Bottom Line on LOVE

Lovesac has navigated challenging market shifts and consumer behavior changes during and since the pandemic. As the market recovers, the company is strategically positioned to capitalize on the potential rise in furniture demand. However, the company’s future earnings forecast indicates a potential dip, adding to the mixed market sentiments reflected in its recent stock performance and the large amount of shares that are currently being shorted. Nevertheless, the stock’s potential as a value play makes Lovesac an interesting proposition for investors willing to weather near-term volatility in anticipation of longer-term gains.