Quantum computing firm IonQ (IONQ) is scheduled to announce its first-quarter 2025 earnings on Wednesday, May 7, after the market closes. Analysts anticipate an earnings per share loss of approximately -$0.26, compared to a loss of -$0.19 in the previous year’s quarter. Furthermore, revenue is expected to be around $7.5 million, a decrease from $11.7 million in Q4 2024, which is in line with IonQ’s guidance of $7 million to $8 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth noting that IonQ has been working to expand its capabilities in quantum computing and networking. In the last quarter, the company completed the acquisition of Qubitekk and secured a controlling stake in ID Quantique to add nearly 300 quantum networking patents to its portfolio. Additionally, IonQ was selected to participate in the U.S. Defense Advanced Research Projects Agency’s (DARPA) Quantum Benchmarking Initiative, which looks to evaluate quantum computing technologies for practical applications by 2033.

Nevertheless, despite the company’s move to generate growth, IonQ still faces challenges that are common in the quantum computing sector, such as high operational costs and net losses. However, the company has a strong cash position, with $363.8 million in cash, cash equivalents, and investments as of December 31, 2024, that should give it plenty of runway to work with. Still, investors will undoubtedly be looking to see how much cash the company will have used up during the quarter.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 14.3% move in either direction.

Is IONQ Stock a Buy?

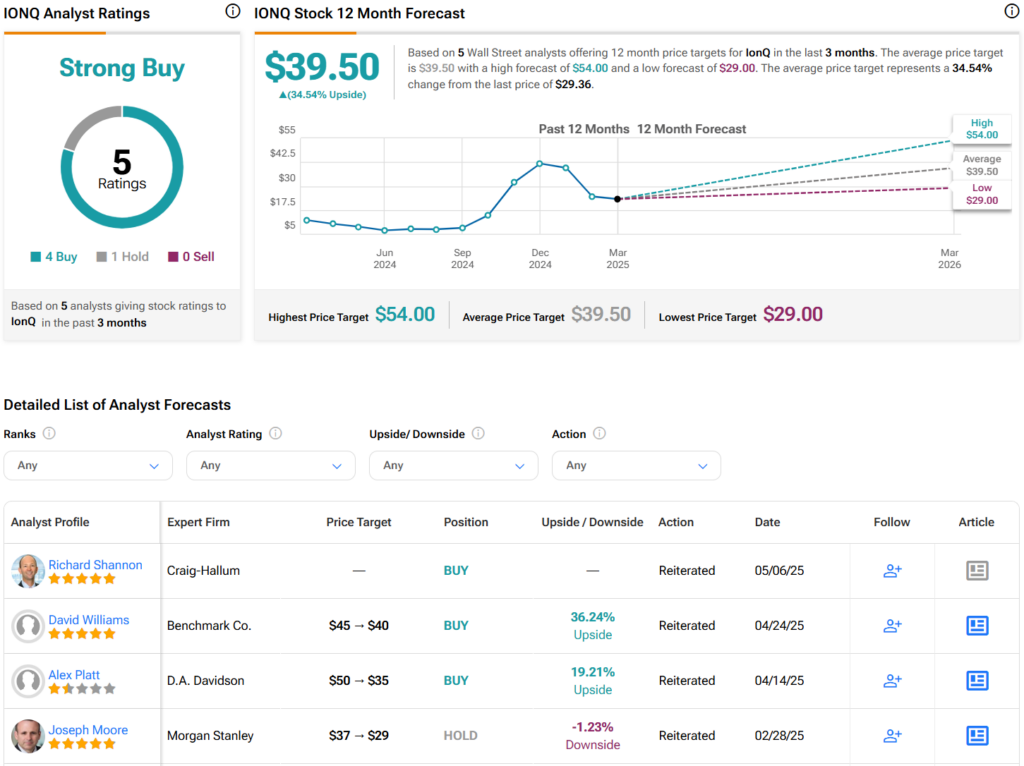

Turning to Wall Street, analysts have a Strong Buy consensus rating on IONQ stock based on four Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average IONQ price target of $39.50 per share implies 34.5% upside potential.