Cybersecurity company CrowdStrike Holdings (CRWD) is scheduled to announce its results for the first quarter of Fiscal 2026 after the market closes on June 3. Ahead of the Q1 earnings, most analysts are bullish on CRWD stock, with spending on cybersecurity expected to be resilient compared to other IT areas in an uncertain macro backdrop. CRWD stock has rallied 37% year-to-date. Heading into the Q1 results, several analysts have raised their price targets for CrowdStrike stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wall Street expects CrowdStrike’s Q1 FY26 EPS (earnings per share) to decline 29% year-over-year to $0.66. Revenue is expected to grow by 20% to $1.10 billion.

Analysts’ Expectations from CRWD’s Q1 Earnings

Heading into Q1 earnings, Stifel analyst Adam Borg increased the price target for CrowdStrike Holdings stock to $480 from $435, while reiterating a Buy rating. The 5-star analyst expects the company to report a slight upside, given that the company said that its fiscal first-quarter results will be at least in line with its guidance and reaffirmed the full-year guidance.

Based on a survey, Borg said that the company’s last year’s faulty update continues to have a diminishing impact on deals and partners’ 2025 pipelines. Further, when taking a 3-5 year view, the survey indicates that most respondents do not believe that the outage incident due to the faulty update will impact CrowdStrike’s perception, competitive positioning, and growth rate/market opportunity.

Likewise, KeyBanc analyst Eric Heath increased his price target for CrowdStrike Holdings stock to $495 from $450 and reaffirmed a Buy rating. The 5-star analyst continues to see CRWD as a leading consolidator of security with its “broad, unified platform and pervasiveness in endpoint” supporting expansion into several large adjacencies, including SIEM (security information and event management), CNAPP (cloud-native application protection platform), identity, data security, exposure management, managed services, and more.

Heath added that while macro pressures remain a concern, he continues to see opportunity for ARR (annual recurring revenue) acceleration in the second half of the fiscal year, as the company “anniversaries the Federal distributor deal and the customer commitment packages.”

Is CRWD Stock a Good Buy?

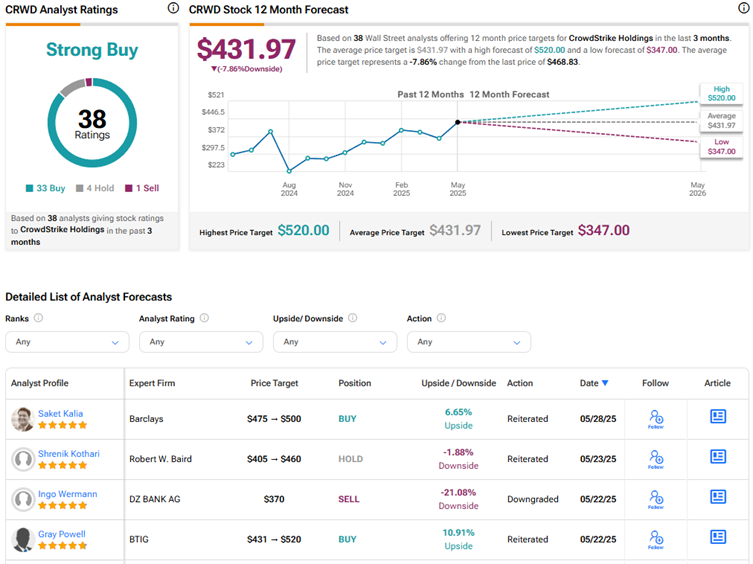

With 33 Buys, four Holds, and one Sell recommendation, CrowdStrike scores a Strong Buy consensus rating on TipRanks. The average CRWD stock price target of $431.97 implies a downside risk of about 8% from current levels, given the year-to-date rally in the stock.