Conagra Brands (CAG) is set to release its first-quarter fiscal 2026 earnings on October 1, before the market opens. Analysts are projecting a sharp decline in both earnings and sales this quarter due to persistent inflationary pressures on beef and higher tariffs. Notably, Conagra has missed Wall Street’s expectations in three of the past eight quarters, signaling ongoing challenges for the packaged foods company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Street expects Conagra Brands to report a 37.7% year-over-year decline in adjusted earnings to $0.33 per share. At the same time, sales are estimated to fall 6.6% to $2.62 billion compared to the same period last year.

Beef prices remain at record highs, driven by tight supply and strong demand, with farmers hesitant to expand herds and are selling high-priced heifers to manage debt. Unfortunately, under President Donald Trump’s administration, U.S. beef exports to China declined sharply due to expired permits and tariffs, leading Australia to take over as China’s main beef supplier.

Analyst Insights Ahead of Results

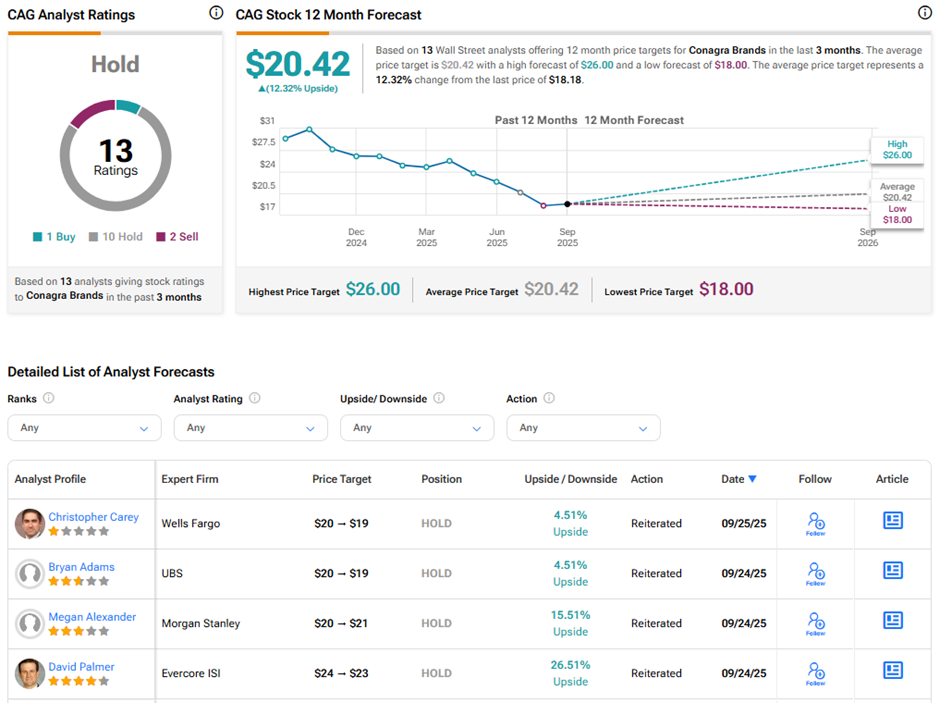

Seven analysts have reiterated their “Hold” ratings on Conagra stock ahead of the results.

Evercore ISI analyst David Palmer cut his price target on CAG from $24 to $23, implying 26.5% upside potential from current levels. Palmer noted that although Conagra has some areas of strength, the company is expected to face another tough year, with fiscal 2026 seen as a transition period, challenged by rising commodity costs, especially beef, and increased tariffs. For reference, management guided for FY26 adjusted EPS in the range of $1.70 per share to $1.85 per share, well below the $2.30 delivered in fiscal 2025.

Similarly, UBS analyst Bryan Adams lowered his CAG price target from $20 to $19, implying 4.5% upside potential. Adams highlighted that expectations for Q1 fundamentals are already muted, with consensus pointing to a 35% year-over-year drop in EPS, pressured by inflation and tariff headwinds. Meanwhile, organic sales are expected to continue declining in the low single digits. Adams added that Q1 is unlikely to shift the broader narrative about Conagra in a meaningful way.

Conversely, Morgan Stanley analyst Megan Alexander raised her price target from $20 to $21, implying 15.5% upside potential. Alexander expects Q1 results to align closely with expectations and reaffirm FY26 guidance. However, she warns that Q2 consensus estimates could face risks due to persistent protein cost pressures and weaker-than-expected scanner trends so far this quarter.

Overall, analysts remain wary of the ongoing headwinds in the packaged foods industry. Conagra has been facing higher costs for raw materials, packaging, labor, and shipping, especially from proteins like beef and poultry, as well as materials like tinplate steel due to tariffs.

Is CAG Stock a Buy, Hold, or Sell?

On TipRanks, CAG stock has a Hold consensus rating based on one Buy, 10 Holds, and two Sell ratings. The average Conagra Brands price target of $20.42 implies 12.3% upside potential from current levels. Year-to-date, CAG stock has lost 31.4%.