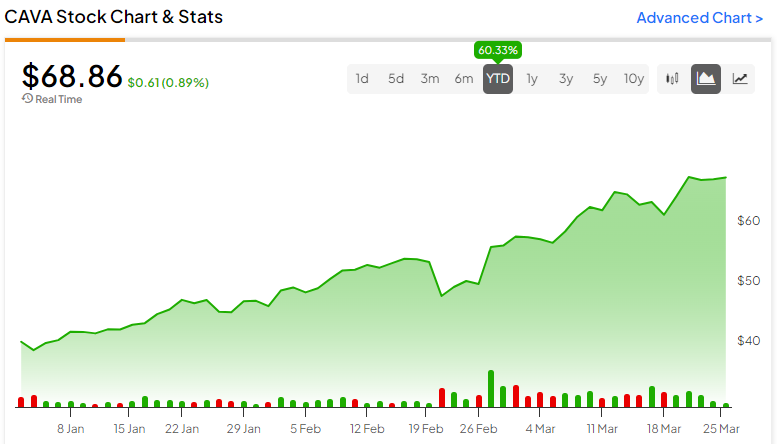

Cava Group (NYSE:CAVA) has been an exciting stock, with a 60% gain to start the year, and the fast-food restaurant chain has received comparisons to Chipotle (NYSE:CMG). It’s a healthier fast-food restaurant that offers Mediterranean food and enjoys similar catalysts to Chipotle. I believe that Cava has the potential to become the next Chipotle, prompting long-term bullishness. However, the valuation offers a reason to wait on the sidelines for now. Therefore, I am currently neutral on CAVA.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cava Is Still Small

Cava currently has a $7.8 billion market cap and has more than 300 restaurants in 25 states and territories. That’s small compared to Chipotle’s $81 billion market cap and 3,000+ restaurants. Being dubbed “The Next Chipotle” has certainly brought attention to CAVA stock. Investors stand to receive a massive payday if the company lives up to expectations.

Cava anticipates opening 48 to 52 new restaurants in Fiscal 2024, a drop from the 72 openings in 2023. If the company reaches the midpoint of 50 new restaurant openings, its total number of restaurants will increase by roughly 16% year-over-year.

Meanwhile, Chipotle closed in 2023 with 3,437 restaurants and plans to open an additional 285 to 315 restaurants in 2024. The 300 midpoint implies an 8.7% increase in the total number of restaurants.

Cava is small but is expanding faster than Chipotle. That makes sense since Cava is in the early innings of its growth phase. If Cava opens 15% more restaurants each year for the next 10 years, the company will end up with roughly 1,250 restaurants. It’s hard to plan that far in advance, but it’s good for investors to know how compounded growth can result in a sizable restaurant chain.

Expanding Profit Margins

Cava has been delivering on revenue and earnings growth. Cava’s revenue has increased by 52.5% year-over-year in the fourth quarter of 2024. Moreover, net income came to $2.0 million compared to a net loss of $18.8 million in the same period last year. Fiscal 2023 net income came to $13.3 million compared to a net loss of $59.0 million in the previous year.

Profit margins are still in the low single digits, but Cava will have many opportunities over the years to improve its margins. Higher profit margins will improve its valuation and can help the stock command a higher price in the future.

The Mediterranean Diet Has Been Gaining Traction

Chipotle chose to offer healthier fast food choices while operating in the high-demand Mexican grill segment. Those catalysts helped the corporation gain market share and become a top fast-food choice for many consumers.

Cava has the health component down, thanks to its focus on Mediterranean meals. The Mediterranean diet has received a lot of coverage and was even ranked as the top diet by U.S. News & World Report. Cava leans into this dietary trend. It’s in the right industry to gobble up market share from its competitors, especially as consumers become more health-conscious.

The High Valuation

Cava carries a lot of promise and can be a compelling long-term investment opportunity. However, it’s impossible to discuss Cava stock without acknowledging its sky-high valuation. Cava shares trade at an abysmal 326x P/E ratio, which is hard to justify. That valuation can look different in 10 years as the company gains market share, but investors need the best-case scenarios to play out.

Any growth slowdown will immediately bring the valuation into question. Slowdowns in profit margin expansion can also send investors rushing for the exits. Cava is expected to post earnings at the end of May. Any further stock gains will amplify the valuation even more, which can lead to a big decline if earnings are modest.

The stock experienced an unstoppable rally in 2024, which isn’t a good thing. A correction may become necessary and bring the stock lower. Shares dropped by roughly 18% in August 2023 and proceeded to fall by an additional 25% in the following month. If Cava drops, it can fall hard. Long-term investors can use the opportunity to buy dips, but not every investor may want to hold onto the stock when it goes through unfavorable price swings.

Is CAVA Stock a Buy, According to Analysts?

CAVA stock comes in as a Moderate Buy, according to analysts. Eight analysts rated the fast-food restaurant stock as a Buy, while three recommended it as a Hold. No analyst put a Sell rating on the stock. However, the average CAVA stock price target of $60.40 has exceeded most price targets and now implies 12.1% downside potential. Even the highest price target of $66 per share implies 4% downside. Only one analyst offered a price target in March.

The Bottom Line on CAVA Stock

Cava can become a dominant fast-food restaurant chain thanks to its expansion efforts and a focus on Mediterranean food. The company looks great, but the stock’s valuation is a major concern. A big dip can present a compelling long-term buying opportunity. Cava has the chance to live up to its moniker as “The Next Chipotle,” but the stock won’t always be as smooth as it has been year-to-date.