Per a Wall Street Journal report, ace hedge fund manager Cathie Wood’s venture fund slashed the value of its stake in Elon Musk’s Twitter by 47%. According to Wood, the recent markdown represents a fair valuation. Moreover, the move doesn’t change her fundamental outlook on Twitter, which is bullish. This implies that Wood continues to show faith in Musk’s ability to transform Twitter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Twitter Continues to Struggle

Wood announced a small stake in Twitter via her ARK Venture Fund last year, citing that Musk could turn it into a “Super App.” However, the investment didn’t turn out well. Twitter lost advertising dollars and failed to scale its user base, leading to a significant drop in its valuation.

Further, Wood’s markdown shouldn’t come as a surprise. Earlier, a Fidelity fund slashed the value of its stake in Twitter since Musk bought it for $44 billion.

Twitter remains vulnerable. At the same time, Meta Platforms (NASDAQ:META) launched Threads, which will make it tough for the company to bring back advertisers and scale advertising revenues at a brisk pace.

As for Wood, there are other problems besides for Twitter. The AUM (assets under management) of her flagship ETF (exchange-traded fund), the ARK Innovation ETF (ARKK), has declined from its peak due to investment losses.

Meanwhile, Musk endured the Twitter misstep, thanks to the stellar recovery in Tesla (NASDAQ:TSLA) stock.

What are the Top 10 Holdings in ARKK?

The image below shows the top 10 holdings of ARKK. While the ARKK ETF’s size is shrinking, its top holdings recovered strongly in 2023, with Coinbase (NASDAQ:COIN), Tesla, Shopify (NYSE:SHOP)(TSE:SHOP), and DraftKings (NASDAQ:DKNG) generating stellar gains on a year-to-date basis.

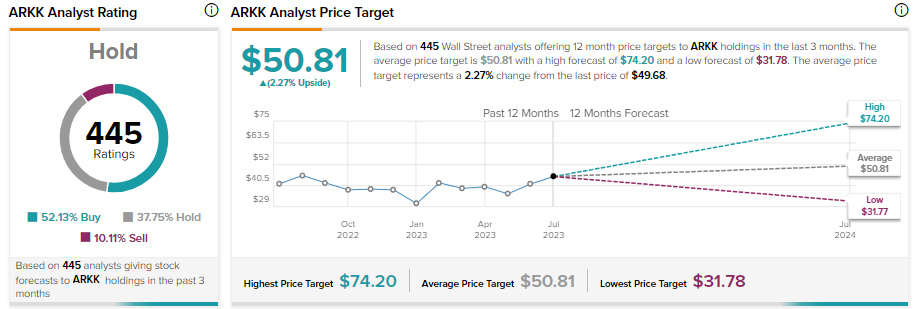

The ARKK ETF has a Neutral Smart Score of seven on TipRanks. Moreover, per the recommendations of 445 analysts giving stock forecasts for its holdings, the 12-month average ARKK price target of $50.81 implies 2.27% upside potential from current levels. The ETF carries a Hold consensus rating on TipRanks.

Among these analysts (providing ratings on its holdings), 52.13% have given a Buy rating, 37.75% have assigned a Hold rating, and 10.11% have given a Sell rating.