Telecommunications firm AT&T (T) is set to report its Q3 earnings results on October 22 before the market opens. Analysts are expecting earnings per share to come in at $0.54 on revenue of $30.87 billion. This compares to last year’s figures of $0.60 and $30.21 billion, respectively. Interestingly, AT&T has a solid track record when it comes to beating earnings, as it has only missed twice since Q2 2021. However, analysts have mixed opinions on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a matter of fact, Scotiabank recently downgraded AT&T from Buy to Hold with a price target of $30.25. Four-star analyst Maher Yaghi expects AT&T to report 2% revenue and EBITDA growth in Q3, mostly driven by strength in mobility and consumer services. However, the business segment continues to lag. While the company has shown steady performance and improved cash flow stability, Scotiabank believes that AT&T could have a hard time beating other telecom stocks unless it delivers a stronger-than-expected earnings surprise, especially given its current valuation and dividend yield.

Separately, Wells Fargo lowered its price target on AT&T to $29 from $31 but kept a Buy rating. 4.5-star analyst Eric Luebchow pointed out that Verizon (VZ) could slow AT&T’s postpaid phone growth if it becomes more aggressive, but still thinks AT&T’s outlook is on track. Long-term, Wells Fargo expects AT&T to benefit from the growing mix of fiber and mobile services, as well as the expansion of fixed wireless access. However, the $23 billion spectrum deal is expected to slightly reduce free cash flow and push back future stock buybacks. As a result, Wells Fargo favors T-Mobile (TMUS) as a better option in the sector.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a 4.76% price move in either direction. This estimate is derived from the $26 strike price, with call options priced at $0.63 and put options at $0.61.

Is AT&T Stock a Buy?

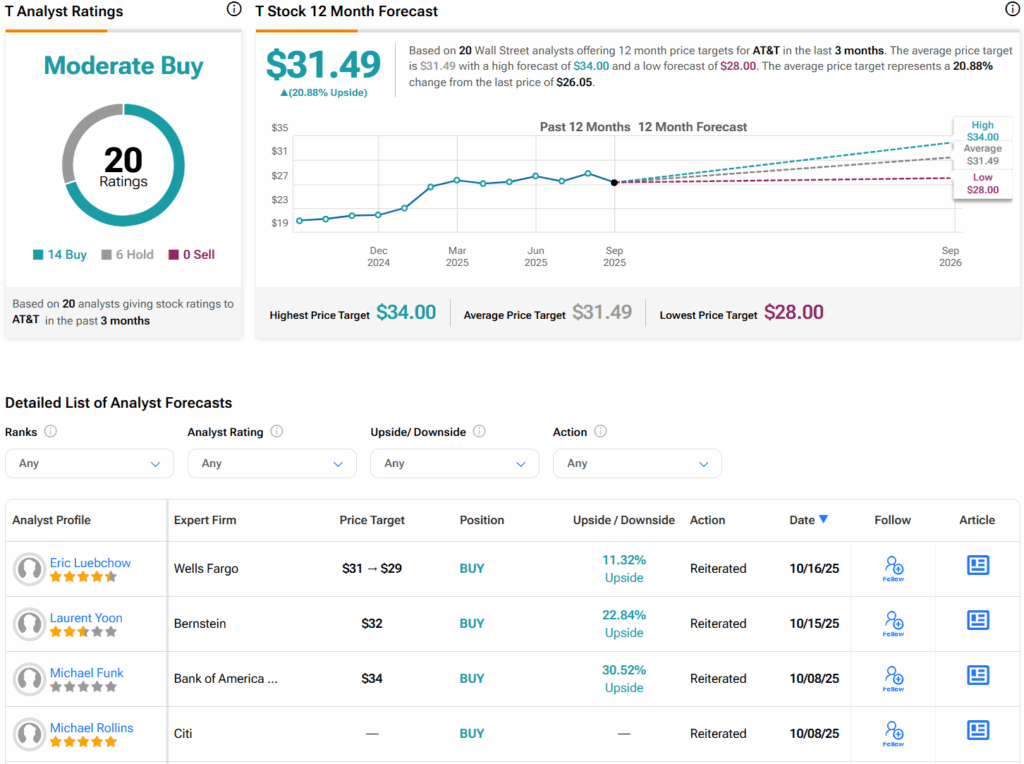

Overall, analysts have a Moderate Buy consensus rating on AT&T stock based on 14 Buy, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AT&T price target of $31.49 per share implies 20.9% upside potential.