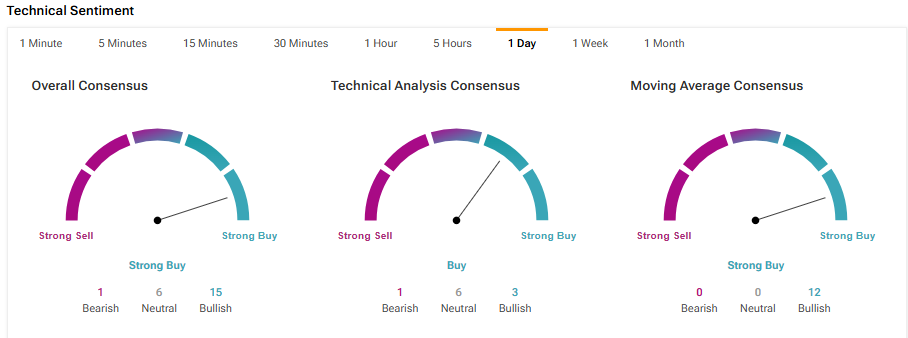

Archer Aviation (ACHR) is a key player in urban air mobility, developing electric vertical takeoff and landing (eVTOL) aircraft for short-distance air taxi services. The company is set to release its Q1 earnings on May 12. The analysts forecast a loss of $0.28, against a loss of $0.36 in last year’s quarter. Ahead of the earnings report, technical indicators suggest that ACHR stock is a Strong Buy, on a one-day timeframe, which implies upside potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking ahead, Archer is working toward Federal Aviation Administration (FAA) approval, a key step for commercial operations. Also, collaborations with United Airlines (UAL), Stellantis (STLA), and Abu Dhabi Aviation are helping the company scale its operations.

Analyzing ACHR Stock’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, Archer Aviation stock is currently on an upward trend. The stock’s 50-day Exponential Moving Average (EMA) is 8.09, while its price is $8.86, implying a bullish signal. Further, its shorter duration EMA (20 days) also signals a Buy.

Moreover, the Rate of Change (ROC) is a momentum-based technical indicator. It measures the percentage change in a stock’s price between the current price and the price from a specific number of periods ago. Typically, a ROC above zero confirms an uptrend. ACHR stock currently has an ROC of 23.39, which signals a Buy.

Another technical indicator, Williams %R, helps traders see if a stock is overbought or oversold. For Archer Aviation, Williams %R currently shows a Buy signal, suggesting the stock is not overbought and has room to run.

Is ACHR a Good Stock to Buy?

On TipRanks, ACHR stock has a Strong Buy consensus rating based on six Buys and one Hold assigned in the last three months. The average Archer Aviation stock price target of $12.83 suggests an upside potential of 43.35% from its current price.