Apple (AAPL) is set to release its fourth-quarter fiscal 2025 results after the market closes on Thursday, October 30. Analysts expect solid growth in both earnings and sales, driven by steady iPhone demand and the company’s ongoing push into artificial intelligence (AI). Importantly, Apple has exceeded Wall Street’s expectations for eight consecutive quarters, reflecting continued momentum and strong performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Expectations from Apple

Valued at nearly $4 trillion, Apple competes in one of the largest global markets for smartphones and wearables. The Street expects Apple to report an 8.5% year-over-year increase in adjusted earnings to $1.78 per share. Additionally, sales are estimated to rise 7.6% to $102.17 billion, up from $94.93 billion in the same period last year.

Import tariffs are likely to keep pressuring Apple’s margins. In Q4, Apple is expected to report gross margins of 46% to 47%, including a tariff impact of $1.1 billion.

Meanwhile, Apple’s Services business is set to exceed $100 billion in annual revenue for the first time in 2025, driven by high-margin offerings like iCloud, Apple Pay, and AppleCare. The segment is expected to generate around $108.6 billion, accounting for roughly 25% to 30% of Apple’s total revenue and growing about 13% year-over-year.

The Services unit contributes up to 50% of Apple’s profit, driven by recurring subscriptions and key deals like making Google (GOOGL) the default search engine on iPhones. However, Apple faces significant legal and regulatory challenges, including antitrust lawsuits in the U.S. and UK, as well as potential caps on App Store fees.

What Analysts Are Saying About Apple

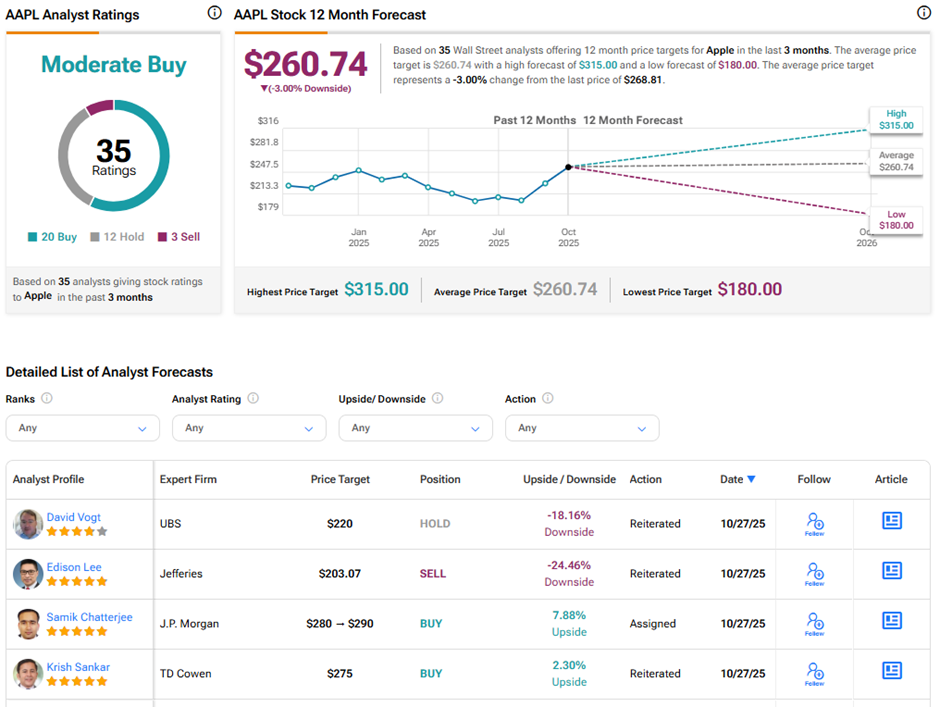

Wall Street remains divided on Apple’s long-term outlook. Ahead of the results, J. P. Morgan analyst Samik Chatterjee reiterated his “Buy” rating on AAPL stock and raised the price target from $280 to $290, implying 7.9% upside potential. He expects high-single-digit revenue growth in both Q4 and Apple’s Q1 outlook, reinforcing investors’ confidence in Apple’s positive product cycle.

UBS analyst David Vogt maintained his “Hold” rating and $220 price target, implying 18.2% downside potential. Vogt prefers to remain sidelined due to slowing demand for iPhones, especially in one of its largest markets China. The company is facing stiff competition from domestic players like Huawei and Xiaomi. Apple did resort to price discounting to boost its iPhone 16 sales, but it has still lagged behind Chinese peers in the mainland. Vogt also believes that Apple stock is currently trading near all-time highs and may be overvalued compared to peers.

Jefferies analyst Edison Lee reiterated his “Sell” rating and kept his $203.07 price target intact, which implies 24.5% downside potential. Lee had recently downgraded the stock, citing concerns that the current stock price already prices in much of the optimism from the iPhone 17 launch. He also worries that investors are setting unrealistically high expectations for future growth, particularly regarding the rumored iPhone 18 and Apple’s first foldable model, although it is not guaranteed.

Apple’s results are expected to remain strong, but opinions are divided. Optimists cite AI and product-driven growth, while skeptics warn that high expectations and valuations may cap gains.

Is Apple a Good Stock to Buy Right Now?

On TipRanks, AAPL stock has a Moderate Buy consensus rating based on 20 Buys, 12 Holds, and three Sell ratings. The average Apple price target of $260.74 implies 3% downside potential from current levels. Year-to-date, AAPL stock has gained 7.7%.