E-commerce giant Amazon (AMZN) saw its stock surge on Monday after President Donald Trump announced an agreement to lower tariffs between the U.S. and China. This agreement will have the U.S. lower its tariffs on China from 145% to 30%, while China reduces its tariffs on the U.S. from 125% to 10%. The agreement is set to last for 90 days and will provide time for additional negotiations between the world’s two largest economies.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

But what does this mean for Amazon?

Amazon was among the companies most impacted by tariffs. Many of the goods sold on its online store come from China. The massive tariffs on imports were expected to drastically increase prices, potentially harming sales to consumers. Some sellers had even planned to skip Amazon Prime Day this year, but those plans might change now that the event will likely take place during the 90-day period of lower tariffs.

Is a Tariff Hold Good News for AMZN Stock?

It most certainly is—and investors know this. Shares of AMZN stock surged 7.76% in pre-market trading on Monday as investors celebrated the trade agreement between the U.S. and China. However, the stock remains down 12% year-to-date.

If President Trump can reach a more permanent agreement with China during the 90-day tariff deal, it would likely be another positive catalyst for AMZN shares and erase the stock’s year-to-date decline. That outcome seems possible as both countries have agreed to continue negotiations throughout the tariff pause.

Is AMZN Stock a Buy, Hold, or Sell?

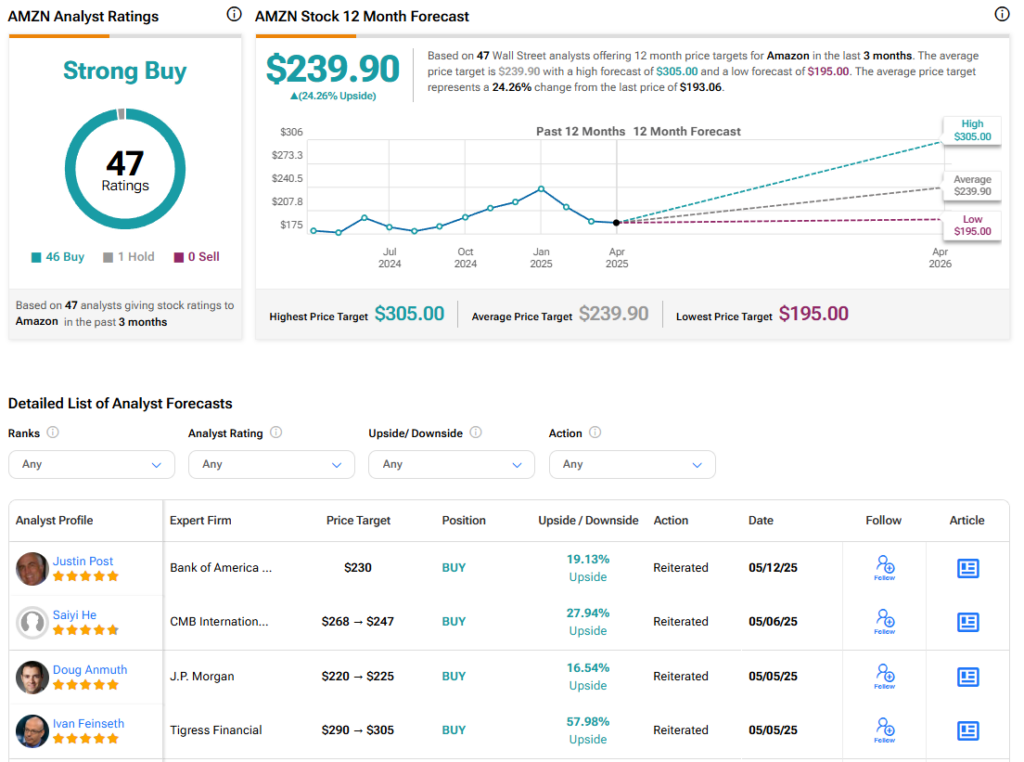

Turning to Wall Street, the analysts’ consensus rating for Amazon is Strong Buy, based on 46 Buy and one Hold ratings over the last three months. With that comes an average AMZN stock price target of $239.90, representing a potential 24.26% upside for the shares.