Tesla, Inc. (NASDAQ:TSLA) provokes strong feelings, and not all of them tied to the company’s performance. Indeed, sentiment has been known to swing on the latest asides in the Trump-Musk relationship in addition to the latest developments with the company’s EV deliveries or technological progress with its more futuristic ambitions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In that vein, last week Tesla unveiled some positive news regarding its Q3 deliveries of 497,099, which were up 7.4% year-over-year. However, the announcement did little to buck up the company’s share price, as TSLA sunk lower in the days since the numbers were shared. Many analysts had been projecting that the company’s Q3 figures would benefit from the September 30 expiration of the $7,500 EV tax credit.

Still, TSLA has been on a nice roll despite the recent stumble, and is up some 95% over the past six months. Investor Daniel Jones isn’t tempted.

“Even though the stock has risen meaningfully in the last couple of months, I view that more as irrational exuberance tied to broader optimism around technology than I do a response to improving fundamentals,” explains the 5-star investor.

Like many others, Jones isn’t assured by the Q3 numbers, believing that the increase was “almost certainly attributable” to the pulling forward of sales due to the expiring tax credit. Furthermore, the investor argues that the EV maker is coming under increased competition from GM in the U.S., which is eating into Tesla’s market share.

Casting a gaze overseas, Jones spots a worrisome trend. In August, for instance, the total number of EVs sold in the EU was up 30.2% year-over-year. And yet, during that same time period Tesla’s EU sales decreased by 36.6%. Year-to-date, Tesla’s EU sales are down 42.9% — a decrease that Jones chalks up to Musk’s unpopular political dalliances.

The company’s valuation is another area of concern for Jones. Using the company’s projected financial performance for the 2025 fiscal year, the investor extrapolates that TSLA’s price-to-earnings multiple has increased from 204.5x to 360.9x between 2024 and 2025.

“I would perhaps be more optimistic about the company if it were not for the fact that shares are trading at insane multiples,” explains Jones, who concludes that TSLA is “woefully overvalued.”

The investor is therefore keeping a Strong Sell rating on TSLA. (To watch Daniel Jones’ track record, click here)

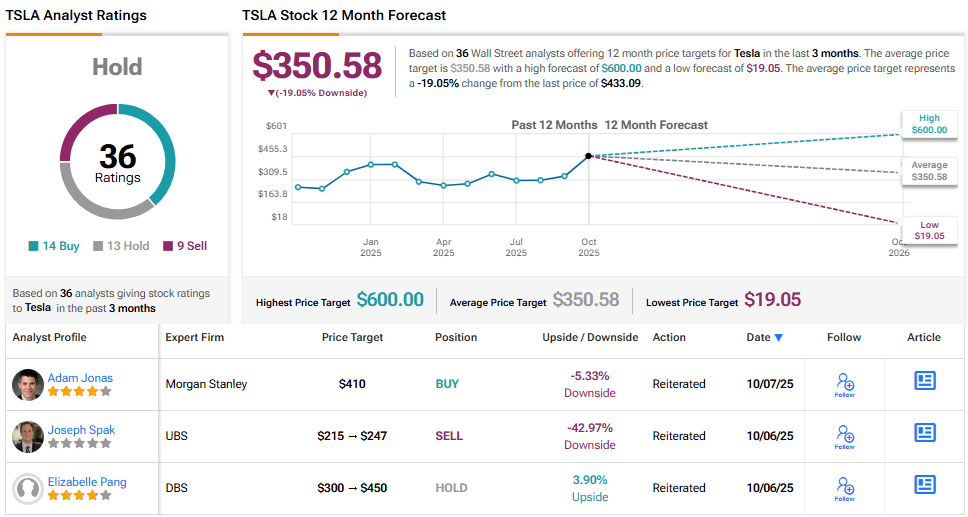

Wall Street is quite mixed when it comes to TSLA. With 14 Buys, 13 Holds, and 9 Sells, TSLA carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $350.58 implies a downside approaching 20%. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.