Yesterday, when Steel Dynamics (NASDAQ:STLD) posted its earnings, it also made some very confident pronouncements about the future of steel purchases. However, that seems a little weaker now than it did then, as iron ore futures are on the decline, and so too are several mining stocks with it.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

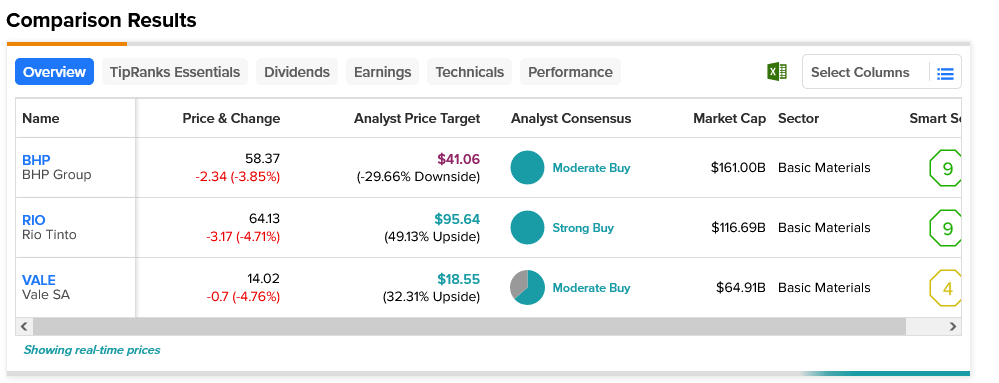

Both May and September iron ore futures are down in a big way, with both trading around the lowest rates seen in the last four months. Three major mining stocks also started the day lower and continued into negative territory in Friday afternoon’s trading. BHP Group (NYSE:BHP) was down 3.85%, while Rio Tinto (NYSE:RIO) dropped 4.71%. The worst hit of all was Vale SA (NYSE:VALE), which fell 4.76%.

So what’s doing a number on iron ore? A report from Morgan Stanley suggests that China’s production is on the decline as the country focuses more on scrap steel. Meanwhile, a report from Fitch suggests that China is again the issue, but this time, it’s a shift in China’s overall economy. China is moving away from growth led by investment and more toward growth led by consumption. But regardless, the points remain: right now, iron ore is sitting unmoved at ports because demand for the stuff is in decline. That might be good news for steel producers who can get one of their biggest inputs cheaper, but for miners, it’s a dark day.

Rio Tinto may have taken the second-hardest hit, but it’s the most favored by analysts, with a Strong Buy consensus rating and an upside potential of 49.13% thanks to its average price target of $95.64. Meanwhile, BHP Group is considered a Moderate Buy by analyst consensus, but with a $41.06 average price target, it comes with a downside risk of 29.66%.