Iron Mountain (NYSE:IRM), a records management services provider, trades at a relatively low price-to-FFO (funds from operations, a cash-flow metric used by REITs) ratio of 16.6x, suggesting the company’s stock may be undervalued. As a result, the company presents an appealing dividend opportunity, yielding 3.2%. This dividend could increase, evidenced by last year’s 5% hike. Investors seeking value and steady income will find this to be an attractive option. Thus, I’m bullish on IRM stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In Q4 2023, Iron Mountain became a real estate investment trust (REIT). It also achieved $1.42 billion in revenue, representing an 11% year-over-year increase. The company has consistently increased revenue since Q4 2021, progressing from $1.16 billion in Q4 to its most recent figure. This revenue growth largely reflects Iron Mountain’s strong position in the AI-powered data center industry trend.

However, Iron Mountain could encounter long-term challenges as data storage costs decrease. With relatively low entry barriers, the data center market risks becoming oversupplied. Rising paper costs could also intensify competitive pressures in records management. Iron Mountain’s debt-to-equity (D/E) ratio of 55.78 becomes a concern in this context. This high ratio indicates heavier reliance on borrowed funds, raising questions about the company’s financial leverage in a tighter market.

Despite these concerns, analysts project that Iron Mountain will achieve 8.4% revenue growth in FY 2024, nearly double the 4.4% forecast for other specialized REITs. Furthermore, analysts predict solid long-term growth, with FY 2026 revenue reaching $7.175 billion, a 30.9% increase over FY 2023. In addition to these factors, this stock is attractive based on its steady revenue growth, price-to-FFO ratio, and quality dividend opportunity.

IRM: Not Resting on Its Laurels

In late 2022, Iron Mountain launched a new strategic growth plan, Project Matterhorn. The initiative aims to pivot from a product-focused sales approach to a solution-oriented approach. As part of this approach, the company intends to expand its reach in large global markets by promoting shared services and best practices. The initiative aims to enhance its cross-selling strategies by leveraging Iron Mountain’s diverse offerings in digital services, traditional records management, and secure shredding.

Iron Mountain management credits a range of recent accomplishments to the success of this initiative, including the digitization of contracts in Brazil, Hungary, Canada, and the UK. In the United States, Iron Mountain has secured a significant partnership with a major health system, managing records for 140 hospitals and 2,600 care sites. These endeavors emphasize compliance and cost efficiency, highlighting the company’s commitment to effective records management.

The company’s data center business is also performing well. In February 2024, Iron Mountain announced that it had secured contracts for 124 megawatts of data center capacity. The demand for data center capacity is being driven upward by cloud computing and the growing use of AI technologies.

In the Q4-2023 earnings call, Iron Mountain CEO Bill Meaney stated, “Our records management business is a 70% plus gross margin business that generates a lot of cash, and that gives us deeper pockets than some of the pure play data center places — players in terms of being able to both deliver our dividend and — growth and dividend to our shareholders as well as putting capital to work in data center as I said. And it just so happens that 225,000 plus customer base is a cross-selling opportunity for us.”

Iron Mountain’s Asset Lifecycle Management (ALM) business is gaining momentum, securing contracts with a global financial services company and a U.S. vehicle insurance firm. The company’s recent acquisition of Regency Technologies underscores Iron Mountain’s commitment to enhancing these services.

IRM Boasts Mostly Strong Financials

Iron Mountain generates most of its revenue from storage operations and the remainder from various value-added services. The company primarily targets enterprise clients, including numerous Fortune 1000 companies with larger, more stable contracts. For FY 2024, the company projects its total revenue to be within the range of $6 billion to $6.15 billion, representing a year-over-year growth rate of 11%.

Iron Mountain also anticipates a significant increase in adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of around 12% to $2.2 billion in FY 2024 compared to the 7% increase to nearly $2 billion recorded in FY 2023.

Recent financial metrics reflect Iron Mountain’s financial health. The company’s net margin of 2.01% in Q4 2023, calculated as net income divided by revenue, reflects effective cost management and solidifies profitability. Similarly, its operating margin of 21.39% for Q4 2023, calculated as earnings divided by revenue, underscores its strong operational efficiency.

Furthermore, the company’s impressive 12% return on equity (ROE) demonstrates effective use of shareholder capital and strong financial performance. Likewise, the company’s Q4-2023 earnings per share (EPS) of $0.52 was higher than the consensus estimate of $0.45. Analysts project EPS to grow by 29.3% per annum.

However, Iron Mountain’s asset management is less impressive, with a return on assets (ROA) of just 0.17%, indicating poor asset use. Furthermore, the company’s high D/E ratio of 55.78 suggests it may face challenges in securing additional borrowing, owing to its increased leverage.

Is IRM Stock a Buy, According to Analysts?

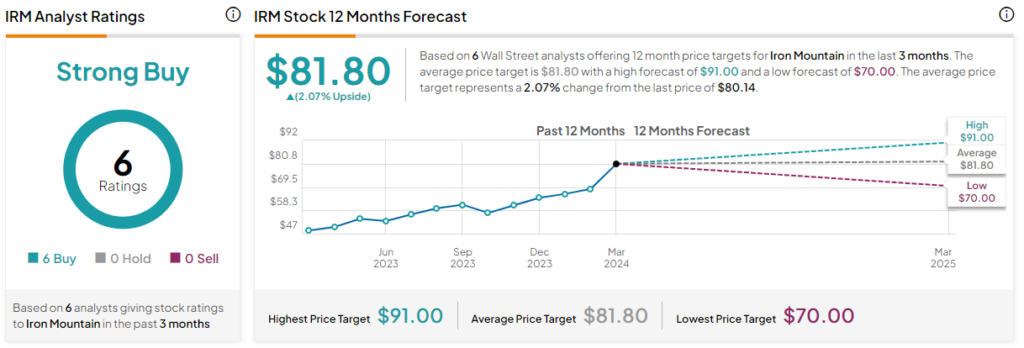

According to TipRanks, IRM is currently rated as a Strong Buy, as evidenced by six Buy ratings and the absence of Hold or Sell ratings from financial analysts over the past three months. The average Iron Mountain stock price target is set at $81.80, implying 2.07% upside from its last price. These analyst price targets vary, ranging from a low of $70.00 per share to a high of $91.00 per share.

Final Insight on IRM

Iron Mountain’s steady stock price growth reflects investors’ positive sentiment about continued growth. The company’s Project Matterhorn initiative appears to be a smart play, given its pivot to solution-based focus and recent business successes.

And while the digital storage sector is often perceived as having a low entry barrier, there seems to be no significant competition emerging. Furthermore, despite concerns regarding its debt-to-equity ratio, the company’s solid financial metrics reinforce my bullish perspective.