Quantum computing stocks have gained significant attention this year, as investors bet on the potential of this technology following the artificial intelligence (AI) boom. The three large pure-play quantum stocks in this sector are IonQ Inc. (IONQ), Rigetti Computing (RGTI), and D-Wave Computing (QBTS).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Year-to-date, IONQ stock has surged over 96%, RGTI stock has rocketed nearly 260%, and QBTS stock has surged the most, rising by 383%. Each company uses a distinctive strategy and presents a different risk profile within the rapidly advancing quantum computing industry.

IonQ Boasts Commercial Focus and Growth Potential

IonQ has a distinct technical approach and a commercially advanced model that sets it apart from its peers. IonQ uses a trapped-ion approach, which is more economical than the popular superconducting approach because it can be conducted at room temperature.

Furthermore, IonQ currently outperforms with a higher accuracy score as measured by gate fidelity tests. Its two-qubit gate fidelity is 99.97%, compared to Rigetti’s 99.5%. Though the difference of 0.47% appears marginal, in quantum computing even fractional improvements are difficult to achieve and can dramatically impact results.

IonQ has also shown strong revenue growth, with annual expectations to more than double year-over-year and reaching over $27 million in Q3 2025. IonQ recently secured $1 billion in equity financing to fuel aggressive expansion and strategic acquisitions, including Oxford Ionics and Vector Atomic, which bolster its quantum sensing and positioning capabilities.

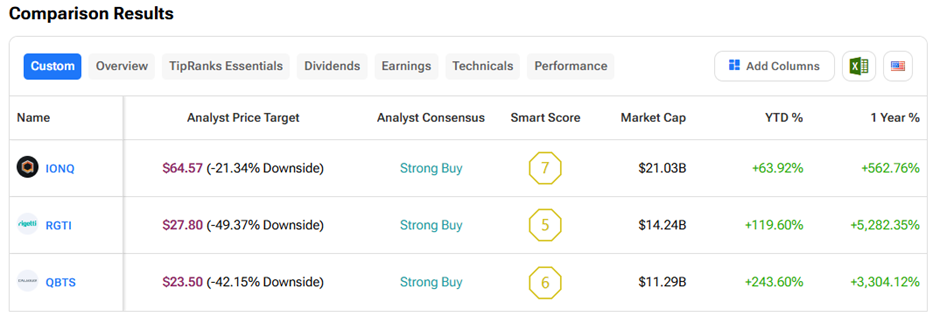

On TipRanks, IONQ stock has a Strong Buy consensus rating based on six Buys and two Hold ratings. The average IonQ price target of $64.57 implies 21.3% downside potential from current levels.

Rigetti Has a Technology-Driven Beat

Rigetti specializes in building superconducting quantum chips and the related hardware and software infrastructure. It was one of the first to deliver a full-stack quantum computing solution. Rigetti offers a cloud platform called Rigetti Quantum Cloud Services (QCS) that allows developers to write and test quantum algorithms remotely. Its quantum approach is similar to those from IBM (IBM) and Alphabet (GOOGL).

Rigetti’s modular approach aims at scaling to 100+ qubits by the end of 2025, with a vision toward over 1,000 qubits in the near future. While near-term revenue remains modest at around $1.8 million last quarter, the company benefits from a vertically integrated technology stack and cloud-based quantum services, attracting significant interest from institutional investors.

On TipRanks, RGTI stock also commands a Strong Buy consensus rating based on seven unanimous Buy ratings. The average Rigetti Computing price target of $27.80 implies 49.4% downside potential from current levels.

D-Wave Boasts Annealing Specialty

D-Wave specializes in quantum annealing, focused on solving complex problems by finding the “lowest point” in a landscape that represents all possible answers. This lowest point represents the best or optimal solution to the problem. In Q2FY25, D-Wave’s revenue grew 42% year-over-year to $3.10 million, and non-GAAP gross profit jumped 39% to $2.22 million.

Although the company operates differently from gate-based rivals, it has captured market attention with scalable and accessible quantum platforms, with applications in logistics, manufacturing, finance, AI, and scientific research. Having said that, its higher volatility and reliance on a specific quantum methodology may present elevated risk compared to IONQ and Rigetti.

With 10 unanimous Buy ratings, QBTS stock has a Strong Buy consensus rating on TipRanks. The average D-Wave Quantum price target of $23.50 implies 42.2% downside potential from current levels.

Concluding Thoughts

IonQ, Rigetti, and D-Wave specialize in different quantum computing approaches, and each stock has experienced significant growth this year. All three stocks have also earned Wall Street’s “Strong Buy” consensus rating, with IONQ stock offering the lowest downside risk among them. IonQ has the most commercially advanced models, generates higher revenue compared to RGTI and QBTS, and also achieves better accuracy.