Shares of IonQ (IONQ) slipped in after-hours trading after the quantum computing company reported earnings for its first quarter of Fiscal Year 2025. Earnings per share came in at -$0.14, which beat analysts’ consensus estimate of -$0.26 per share. In addition, sales decreased by 0.2% year-over-year, with revenue hitting $7.57 million. This also beat analysts’ expectations of $7.51 million. It is also worth noting that as of March 31, 2025, IonQ’s cash reserves stood at $697.1 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Separately, IonQ announced plans to acquire Lightsynq Technologies, a Boston startup founded by former Harvard quantum experts. This move is expected to speed up IonQ’s progress in both quantum networking and computing. CEO Niccolo de Masi explained that the deal will help scale quantum networks through quantum repeaters and increase computing power using photonic interconnects. The acquisition will also bring Lightsynq’s founders and team to IonQ.

Interestingly, its technology is seen as crucial to helping IonQ build quantum computers that can eventually handle tens of thousands to millions of qubits. Lightsynq focuses on photonic interconnect platforms that enable fast, reliable, and scalable qubit operations. These technologies will integrate with IonQ’s quantum processors and help advance plans for building a quantum internet, which could have major benefits for industries like finance, telecom, aerospace, and defense.

Is IONQ Stock a Buy?

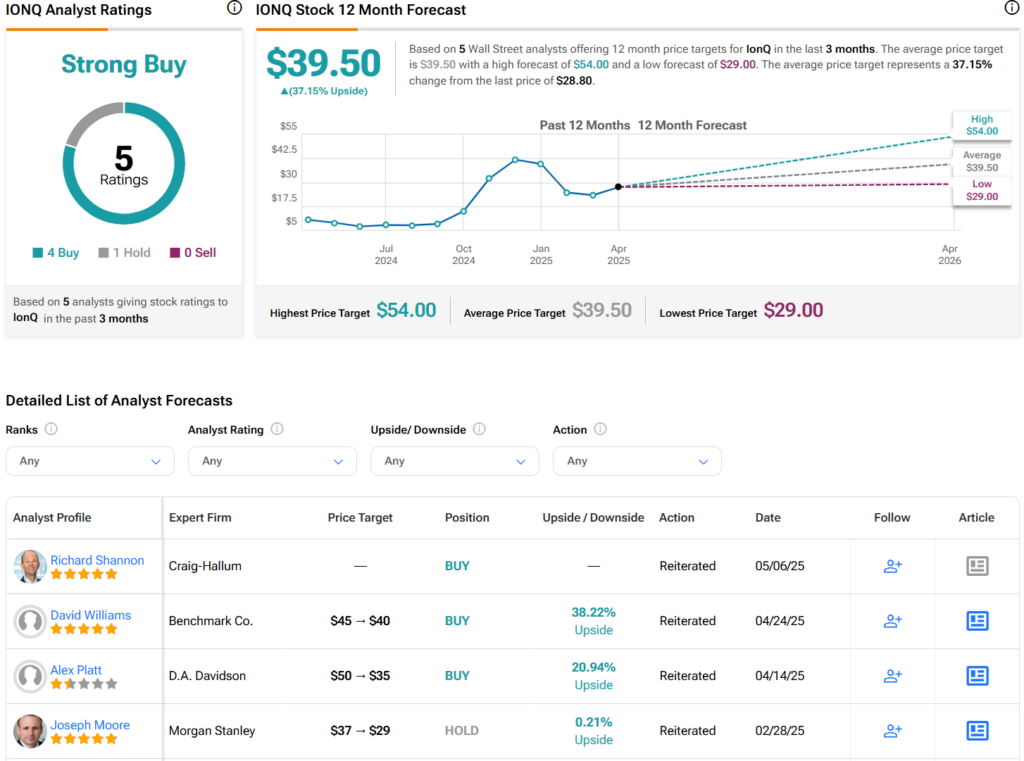

Turning to Wall Street, analysts have a Strong Buy consensus rating on IONQ stock based on four Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average IONQ price target of $39.50 per share implies 37.2% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.