Shares of Lucid Group (NASDAQ:LCID) declined nearly 9% on Wednesday’s extended trading session following the company’s $3 billion stock offering announcement. Last December, the EV maker raised funds of about $1.5 billion to strengthen its balance sheet.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The primary investment will come from the Saudi Arabia Public Investment Fund (PIF), which will continue to control more than 60% of Lucid. The business reported that PIF has agreed to purchase over 265 million additional shares of LCID stock worth $1.8 billion in a private placement.

The remaining amount would be raised through a public offering of more than 173 million shares that commenced yesterday. Bank of America (BAC) is acting as the sole book-runner for the public offering.

Importantly, Lucid plans to use the total amount raised for general corporate purposes, including capital expenditures and working capital.

Should I Buy or Sell LCID Stock?

The capital raise is likely a short-term remedy for the deficiency in the company’s liquidity position. Lucid’s primary problems include raising production levels and sales of its automobiles. Furthermore, severe rivalry in the EV industry and an uncertain macro environment contribute to LCID’s challenges.

Wall Street’s Moderate Buy consensus rating for Lucid stock is based on five Buys, two Holds, and one Sell. The average price target of $8.64 implies 11.3% upside. Shares have risen over 25% since the start of 2023.

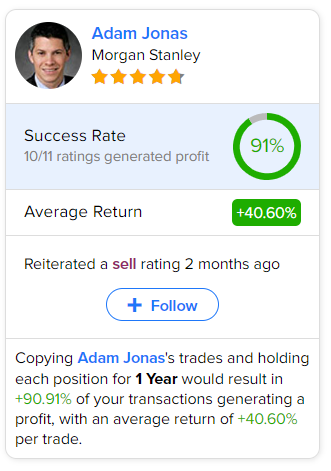

Investors looking for the most accurate and profitable analyst for Lucid could follow Morgan Stanley analyst Adam Jonas. Copying the analyst’s trades on this stock and holding each position for one year could result in 91% of your transactions generating a profit, with an average return of 40.6% per trade.