The ongoing battle for control over the Disney (NYSE:DIS) board of directors seems to only heat up, as new reports suggest that Nelson Peltz of Trian Group got a little extra support. But Disney isn’t letting Peltz take over slots without a fight. Meanwhile, the proxy battle seems to have reinvigorated investors, as Disney shares were up nearly 3% in the closing minutes of Monday’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is the last week until the vote actually goes down, and it’s a pretty safe bet that some will be only too happy to see this finally reach a conclusion. Peltz currently has himself and former Disney CFO Jay Rasulo up for seats, while Blackwells Capital has three interested parties of its own throwing hats into the ring.

Trian offered up a public statement to try and pull support, noting it’s not planning to fire CEO Bob Iger but simply improve accountability. The board is skilled enough, Peltz notes, but doesn’t have much skin in the game and is often busy elsewhere.

Analyst Favor

But this isn’t the only thing driving Disney prices right now. Barclays, via analyst Kannan Venkateshwar, upgraded Disney’s rating from Equal Weight to Overweight and bumped the price target from $95 to $135. Why? Part of it is the “incessant Disney-related news flow ahead of the proxy vote.” Throw in a rising tide of positive developments like improving free cash flow and earnings per share (EPS) guidance, and it’s clear that investors are fairly happy. In fact, Venkateshwar looks for “upside narrative surprises” to come, which are likely to help matters.

Is Wayfair Stock a Good Buy?

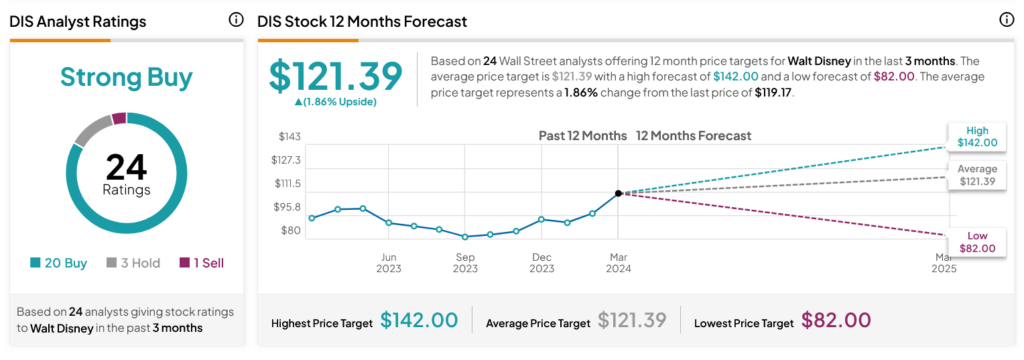

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 20 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 24.94% rally in its share price over the past year, the average DIS price target of $121.39 per share implies 1.86% upside potential.