The U.S. Fed and other regulatory bodies came together to stop the banking crisis at regional banks from spreading. This has calmed investors who turned their backs on equities amid the macro headwinds and ongoing challenges in the banking system. As a result, investors flocked to SPDR S&P 500 ETF Trust (SPY), one of the top ETFs (Exchange Traded Funds), which witnessed massive inflows, per a Bloomberg report.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

According to the report, investors poured $7.3 billion in a single day into SPY, one of the largest investments in a decade, following the regulators’ rush to rescue the crisis-hit banking sector.

With U.S. regulators stepping in to support the banking system and UBS acquiring Credit Suisse, the sector appears to have secured financial stability.

While the recent developments are positive, let’s look at factors that make SPY an attractive investment.

Is SPY a Good ETF?

The SPY, which tracks the S&P 500 Index (SPX), aims to offer similar returns to its benchmark. Further, it is highly diversified, with large-cap stocks from 24 separate industry groups. Thus, it provides exposure to top U.S. corporations and reduces the overall risk.

The ETF has delivered an average annualized return of 12.11% over the past decade. Furthermore, its expense ratio of 0.09% attracts investors. In addition, the ETF has a forward Price/Earnings multiple of 18.05, which is in line with the benchmark index and within investors’ reach.

It’s worth highlighting that its top 10 stocks account for over 25% of its total holdings. TipRanks’ data shows eight out of the top 10 holdings of this ETF sport an Outperform Smart Score. In addition, all these stocks carry a Buy consensus rating, including a Strong or Moderate Buy.

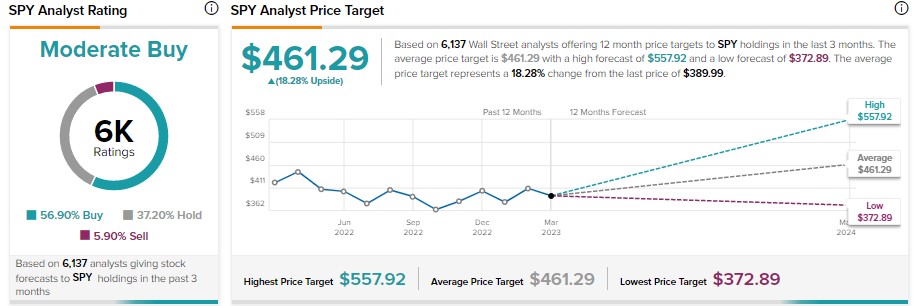

According to the recommendations of 6,137 analysts, the 12-month average SPDR S&P 500 ETF Trust price target of $461.29 implies 18.28% upside potential.