Shares of SoundHound AI (SOUN) have grabbed attention again amid the broader AI stock rally. The stock has jumped over 13% in the past five trading days, bringing its six-month gain to more than 150%. With this rapid rise, short-term upside may be limited, as the stock price has moved above analysts’ average targets. Still, experts remain optimistic about the company’s long-term potential in the growing voice AI market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, SoundHound AI specializes in voice recognition and natural language processing, offering AI-driven solutions across industries.

What’s Driving the SOUN Stock Price?

Over the last 12 months, SOUN stock has grown by 292%. The excitement around SoundHound AI is driven by a mix of AI hype and strong momentum. Its voice AI technology, along with new partnerships and acquisitions, is catching Wall Street’s attention by making the tech more practical and visible. Additionally, the rise of generative AI has investors thinking that voice-based interfaces could be the next major breakthrough.

As a result, the company saw a strong jump in revenue, prompting it to raise its full-year guidance thanks to a growing customer base. In Q2, revenues reached $42.7 million, up 217% year-over-year. Looking ahead, the company expects this momentum to continue, raising its full-year revenue forecast to $160–$178 million, well above last year’s $84.6 million.

What Lies Ahead for SoundHound?

In September, SoundHound AI acquired Interactions, a leader in AI for workflow automation, for $60 million. The move strengthens its position in Agentic AI and is expected to boost operating profitability immediately. These strategic acquisitions and market expansions position SoundHound for long-term growth in the AI sector.

Additionally, the company also holds $230 million in cash with no debt as of June 30, giving it strong financial flexibility to invest in new opportunities and weather economic slowdowns.

Investors, however, should be aware of potential risks from rapid expansion and market volatility. Continued innovation and smooth integration of acquisitions will be key to sustaining SoundHound’s growth and success.

Is SOUN Stock a Good Buy?

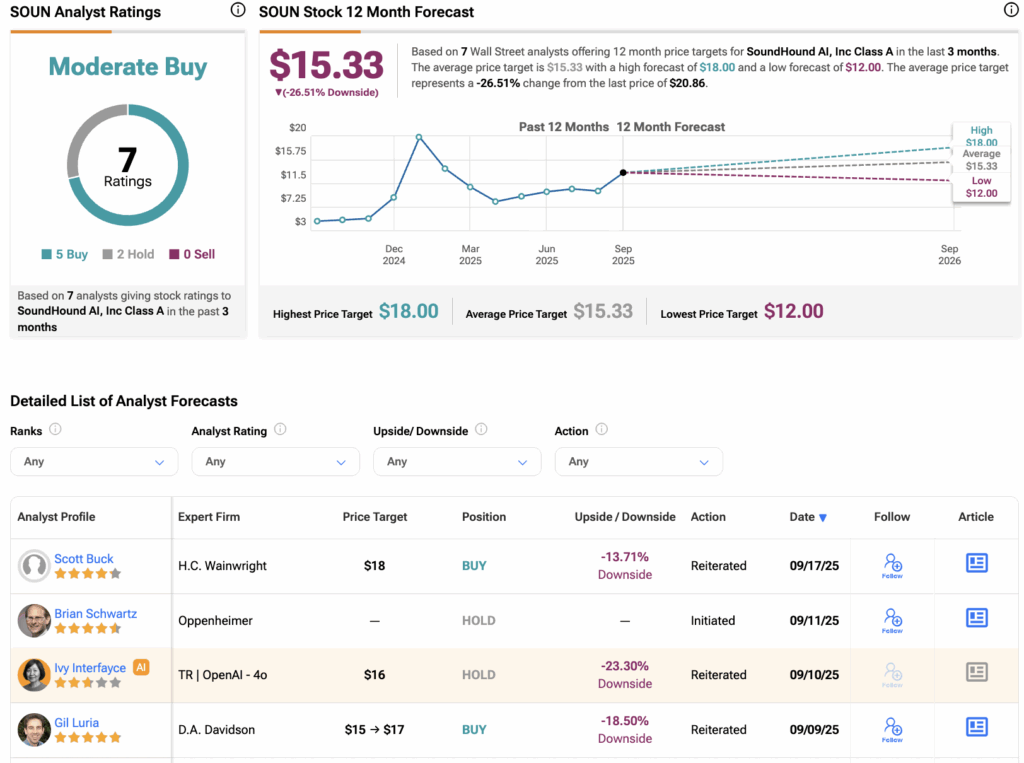

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with five Buys and two Holds assigned in the last three months. The average SoundHound stock price target is $15.33, suggesting a potential downside of 26.51% from the current level.