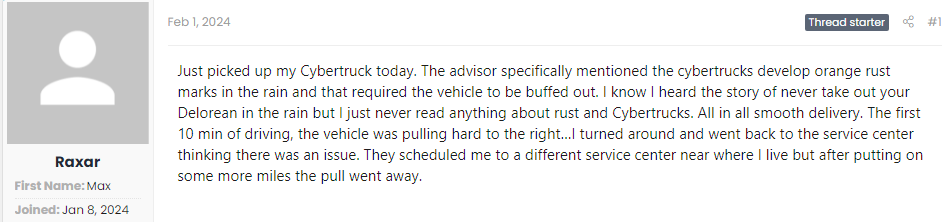

EV major Tesla’s (NASDAQ:TSLA) Cybertrucks are facing a peculiar problem – they are rusting. According to a trending thread in the Cybertruck Owners Club forum, titled “Rust Spots/Corrosion is the Norm,” a user going by “Raxar” stated that after picking up the Cybertruck, “The advisor specifically mentioned the Cybertrucks develop orange rust marks in the rain and that required the vehicle to be buffed out.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Many other Cybertruck owners have complained about the rust issue on different social media platforms, including X, and uploaded videos on YouTube showing orange stains forming on the Cybertruck after driving in the rain.

Considering that Tesla’s Cybertruck is priced at $60,000, the rust might be a serious issue for owners. The Cybertruck’s exterior is made of 30X cold-rolled stainless steel that is tough to mold and offers bulletproof capability. However, it can still be susceptible to rust issues.

For its part, Tesla is offering black or white paint film wraps to cover the trucks’ stainless-steel surfaces to prevent scratches for $6,000. The company is also offering a clear paint film for $5,000.

Tesla’s Institutional Investors Are Bearish on the Stock

Meanwhile, institutional investors seem to be bearish on TSLA. An informal poll conducted by top-rated Morgan Stanley analyst Adam Jonas suggested that these investors expect the stock to underperform over the next six months. Year-to-date, TSLA has slid by more than 15%.

The analyst pointed out several reasons for investor’s concerns.

The analyst stated that Musk’s shift away from a focus on AI raises concerns following tweets hinting at separating AI efforts from Tesla. Jonas added that TSLA’s core auto business made up just 22% of his price target of $345 and noted that the company’s valuation heavily relies on factors beyond its automobile business. The analyst’s price target implies an upside potential of 72.5% at current levels.

Jonas added that the institutional investors raised concerns about the company’s “little to no revenue growth.” Despite record Q4 vehicle deliveries, Tesla’s management provided a dampened growth outlook, as it warned of a potentially lower growth rate when it comes to vehicle volumes compared to 2023.

What Is the Tesla Stock Price Prediction?

Analysts remain sidelined about TSLA stock with a Hold consensus rating based on 12 Buys, 17 Holds, and five Sells. The average TSLA price target of $220.26 implies an upside potential of 10.2% at current levels.