Jack in the Box (NASDAQ:JACK) is enjoying a bit of a renaissance, growing its footprint (including the successful acquisition of Del Taco) while revitalizing its operations. But is it the right time to invest in the company’s stock?

The stock has been on a downward slide, shedding over 50% in the past three years, though the company recently beat earnings expectations, suggesting some progress on turning things around. The stock trades at a discount, making it a potential target for a value trade. However, investors may want to see further progress before establishing a position.

Jack in The Box’ Growing Footprint

Jack in the Box is a restaurant company that operates approximately 2,200 eateries across 22 states and 600 Del Taco outlets across 16 states. Since initiating a franchise development program in mid-2021, the company has signed 93 agreements to open 409 restaurants, 44 of which have been established, leaving a remainder of 365 for future development.

Venturing into the international market, Jack in the Box opened its first restaurant in Mexico in Q2, experiencing remarkable performance. Plans are underway for the second and third outlets in Mexico, with openings scheduled in June and later this year, respectively.

Recent Financial Performance & Outlook

Jack in the Box recently announced its Q2 earnings for the fiscal year 2024. It reported earnings per share (EPS) of $1.46, exceeding analyst forecasts of $1.42 EPS. Total revenue fell slightly short of consensus expectations, reporting a total of $365.35 million with expectations of $368.64 million. This signifies a decline of 7.7% in total revenue compared with the previous fiscal year’s $395.7 million.

During the quarter, the company bought back 0.2 million shares of common stock at a total cost of $15.0 million, leaving $210 million for the stock buyback program authorized by the Board. Furthermore, the Board of Directors has declared a cash dividend of $0.44 per share to be paid on June 25, 2024.

Management revised financial guidance for Fiscal Year 2024. Anticipated adjusted EBITDA of $325-$330 million marks a downward revision from the earlier projection of $325-$335 million. The expected operating EPS is $6.25-$6.40, which decreases from the previous range of $6.25-$6.50.

What Is the Price Target for JACK Stock?

Analysts following the company have been cautiously optimistic about the stock. For example, RBC analyst Logan Reich recently assumed company coverage and assigned the stock an Outperform rating with a $75 price target. He noted that progress in new markets and digital innovation should drive sales growth in the second half of 2024 into 2025.

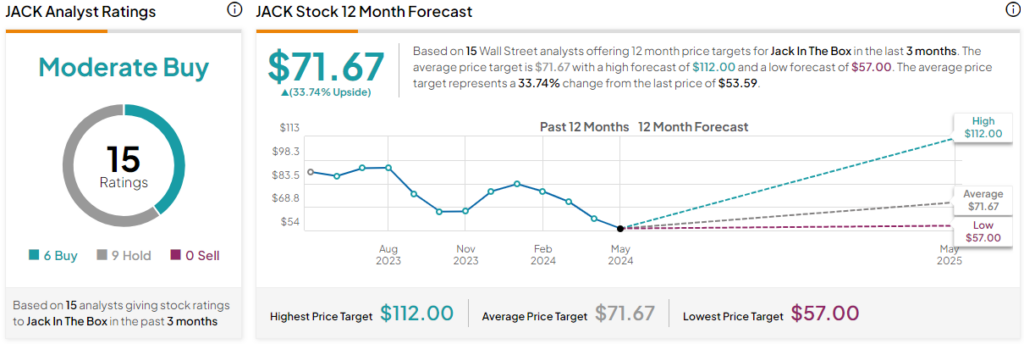

Overall, Jack In The Box is rated a Moderate Buy based on the ratings and price targets assigned by 15 Wall Street analysts over the past three months. The average price target for JACK stock is $71.67, representing a 33.74% upside from current levels.

The stock has been trending down, losing over 23% in the past 90 days. It sits at the low end of its 52-week price range of $52.01-$99.56 and continues to show negative price momentum, trading below its 20-day (54.85) and 50-day (59.45) moving averages. The stock trades at a relative discount with a P/E of 10.68x, significantly below the Restaurant industry average of 25.56x

Final Thoughts on JACK

After a three-year slide, management is taking steps to turn the restaurant’s fortunes around. Green shoots abound, though it’s still too early to tell if the company will make meaningful improvements. The stock trades at a discount, but investors may want to see positive momentum before taking advantage of the value trade.