Intuitive Surgical, Inc. (ISRG) released its preliminary fourth-quarter and full-year fiscal 2021 results, which exceeded analysts’ estimates. Following the news, shares fell 1.5%, closing at $323.16 on January 12.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Intuitive is a technology leader in minimally invasive care, and a pioneer in robotic-assisted surgery. ISRG shares have gained 21.6% over the past year.

Preliminary Results

The company expects preliminary Q4 revenue of $1.55 billion, a 17% year-over-year growth, outpacing analysts’ estimates of $1.51 billion.

Similarly, Q4 Instruments and Accessories revenue is expected to grow by 13% to $843 million, compared to the prior-year quarter revenue of $747 million. The growth is primarily aided by worldwide da Vinci procedures growth of 19% year-over-year.

Similarly, for the full year fiscal 2021, ISRG expects preliminary sales of $5.71 billion, a 31% year-over-year growth. FY21 Instruments and Accessories revenue is expected to grow by 26% annually to $3.10 billion, driven by da Vinci procedures volume growth.

Meanwhile, Q4 Systems revenue is expected to grow 28% year-over-year to $470 million, and the FY21 Systems revenue is expected to grow 44% annually to $1.69 billion.

CEO Comments

ISRG CEO, Gary Guthart, said, “Our customers continued to choose our products in the fourth quarter during a difficult healthcare environment. As we enter 2022, we remain focused on supporting our customers and advancing our innovative ecosystem of platforms, learning, and services aimed at improving minimally invasive care.”

Analysts’ View

Responding to ISRG’s news, analyst Ryan Zimmerman of BTIG stated that the company will see long tailwinds ahead, and reiterated a Buy rating on the stock with a price target of $372 (15.1% upside potential).

Zimmerman said, “Results are largely consistent with our expectations (and our recent upgrade) as Systems exceeded while Instruments & Accessories was subject to the impact of tougher comps versus last year due to the launch of the Extended Use program. Overall procedures/system came in slightly ahead at ~64.8 versus Consensus estimates of ~64.2.”

Overall, the stock has a Moderate Buy consensus rating based on 4 Buys and 7 Holds. The average Intuitive Surgical price target of $362.80 implies 12.3% upside potential to current levels. Intuitive’s upcoming earnings for the fourth quarter are scheduled for January 20, 2022.

Blogger Opinions

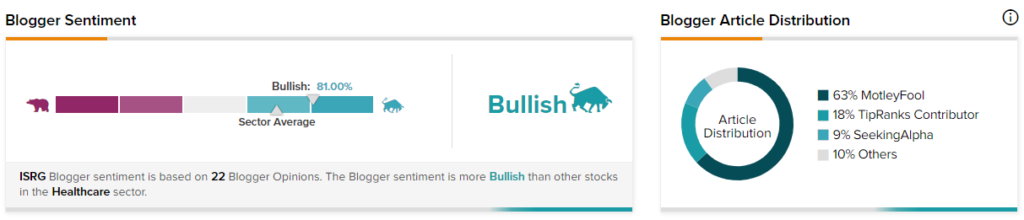

TipRanks data shows that financial blogger opinions are 81% Bullish on ISRG, compared to a sector average of 69%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Musk Criticizes California’s Proposed Solar Tax

Tesla Reports Solid China Sales Numbers for December; Shares Up

U.S. Banks Cut Overdraft Fees for Customers