Intuit (NASDAQ:INTU) shares took a dip in after-hours trading, which could be attributed to the firm’s conservative guidance for the upcoming fiscal first quarter. That said, there was a silver lining: its forecast for FY 2024’s earnings surpassed Wall Street’s prediction ($16.17 to $16.47 vs. $15.96), and its annual revenue projection was on target ($15.890 billion to $16.105 billion vs. $15.976 billion). Moreover, fiscal fourth-quarter figures surpassed expectations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, Q4 adjusted EPS was $1.65, easily outpacing the expected $1.44. However, it’s worth noting the 11% year-over-year decline in Credit Karma revenue to $424M, attributed to macroeconomic factors affecting various sectors. On a brighter note, the Small Business and Self-Employed Group witnessed a substantial 21% revenue leap, reaching $2.1B.

What is the Fair Value of Intuit?

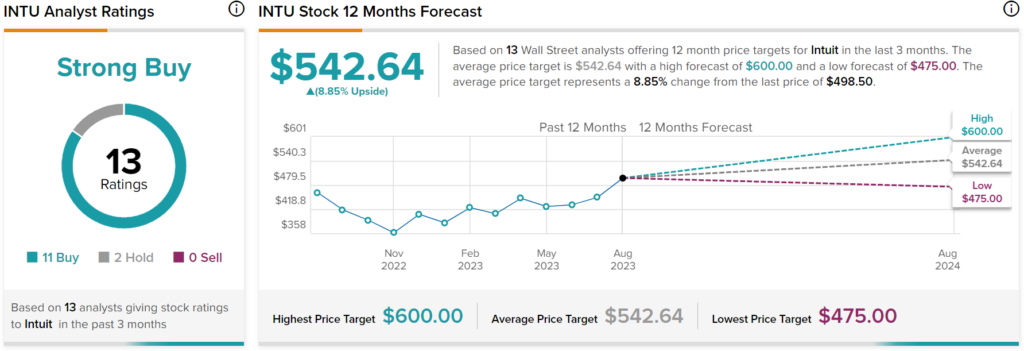

Turning to Wall Street, analysts have a Strong Buy consensus rating on INTU stock based on 11 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $542.64 per share implies 8.85% upside potential.