Chip maker Intel (NASDAQ:INTC) has committed to investing about €80 billion in the European Union or EU over the next decade. This entails establishing a comprehensive semiconductor ecosystem, including research and development, manufacturing, and advanced packaging. However, the company’s European chip-making plans are facing challenges in Germany, as reported by the Wall Street Journal.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In March 2022, Intel took the first step by announcing an initial investment of €17 billion. This investment is earmarked for constructing a cutting-edge semiconductor mega-fabrication facility in Magdeburg, Germany. However, the project has faced challenges from labor shortages and soaring energy prices in Germany.

Nonetheless, Intel’s development of the mega-fabrication facility in Magdeburg received a warm welcome from the German government, as demonstrated by the €10 billion (~$10.6B) in federal subsidies. The move is centered on balancing the global semiconductor supply chain and competing with established players in Asia. In the initial phase, Intel will develop two cutting-edge semiconductor fabrication facilities in Magdeburg, Germany, with production slated to commence in 2027.

The outcome of Intel’s plans in Europe is yet uncertain, but the company has garnered attention with its strong financial performance this year, resulting in an uptick in its stock price. Given this context, let’s delve into analysts’ recommendations for INTC stock.

What is the Outlook for Intel Stock?

Intel stock has gained over 32% year-to-date, reflecting improved financial performance. It jumped to profit in Q2 and delivered stronger-than-expected second-quarter results. Meanwhile, management remains upbeat and expects a sequential improvement in sales and margins.

Intel has been making consistent strides in executing its turnaround strategy and bolstering its financial performance. However, it still grapples with heightened competition and production hurdles that may constrain the potential for gains in its stock. Given these headwinds, analysts remain sidelined on INTC stock.

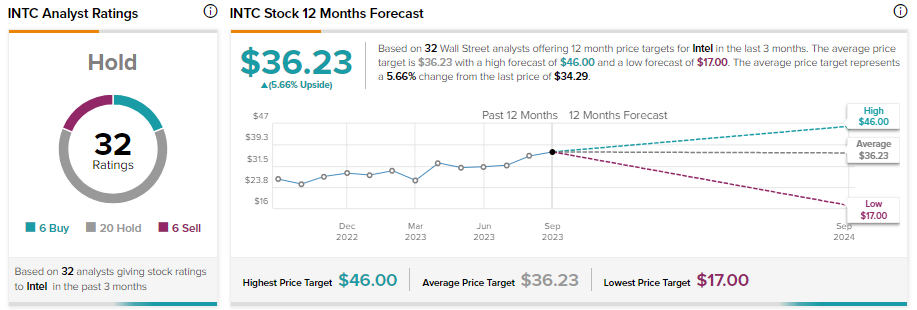

With six Buy, 20 Hold, and six Sell recommendations, Intel stock has a Hold consensus rating on TipRanks. Further, analysts’ average price target of $36.23 implies a limited upside potential of 5.66% from current levels.