The good times are back at Intel Corp. (INTC) as it continues its blistering performance in H2 2025, heading into one of the most highly anticipated earnings seasons in years. With so many proverbial bullets flying over the past quarter, investors are keen to see how all the market chaos has affected the top-tier U.S. stocks. Over the coming month, they’ll soon find out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

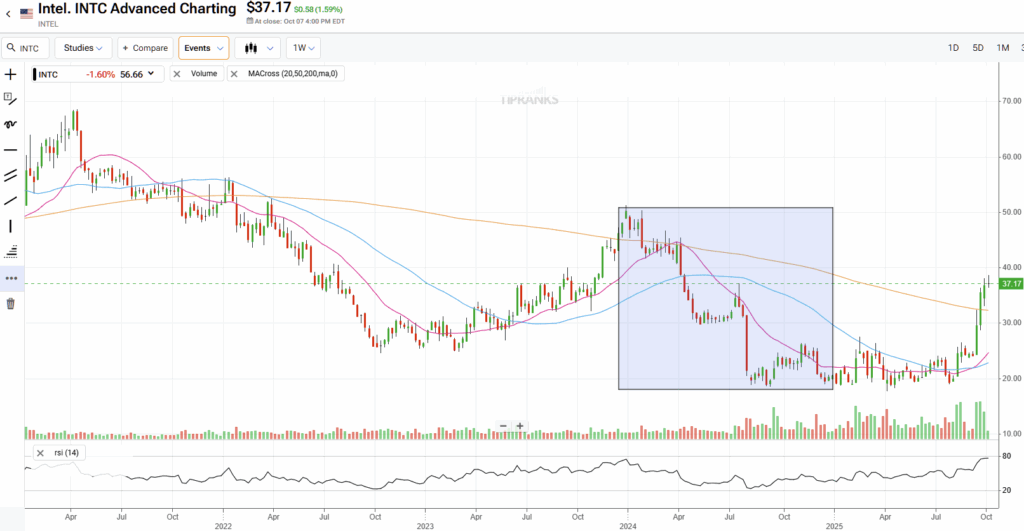

At Intel, the stock is up ~85% year to date, which is a remarkable statement to make about a company that spent much of 2024 taking hits from all angles and declining 60%. However, what a difference a year makes — a flurry of high-stakes capital and headline-grabbing developments, including the U.S. government agreeing to buy a significant stake, Nvidia pledging a $5 billion investment, SoftBank chipping in $2 billion, and, most recently, reports say AMD is kicking the tires on using Intel’s foundry.

With improving visibility around Microsoft (MSFT) as a foundry customer, it’s clear that what’s happening at Intel is a genuine turnaround — one that’s been a long time coming. I believe that momentum can continue, which is why I remain Bullish on Intel’s comeback story.

What Lit the Fuse so Far This Year

The single biggest plot twist this year was that Washington became Intel’s largest shareholder. In August, the U.S. administration announced it would purchase a 9.9% stake in Intel, essentially converting earlier CHIPS Act support into equity. Intel later warned that such a “state-backed” label can complicate international sales, but markets heard something different. The federal government just put real skin in the game to anchor domestic chipmaking. Without delving into the debate over government protectionism of private markets, investors viewed the move as a green light to buy.

Then, out of nowhere, Nvidia (NVDA) announced a $5 billion investment in Intel, alongside plans to collaborate on AI infrastructure and PC products. That signaled industry validation at a moment Intel badly needed it. A few days earlier, SoftBank stepped in with a $2 billion equity infusion, marking another vote of confidence from one of the world’s most aggressive tech investors.

There was strong operational news, too, as Reuters reported that Microsoft will use Intel’s 18A process for an undisclosed chip (an early customer win for Intel Foundry), and, just a few days ago, fresh reports said Advanced Micro Devices (AMD) is in early talks to become a foundry customer as well. Even the rumor of AMD shifting a sliver of production onshore is a significant symbolic win, and it helps explain why the stock has been bid up on every foundry headline this fall.

Why the Push Could Keep Going

The stakes are now bigger than one company. If Intel executes on its 18A roadmap and converts interest into signed, sizable wafers, it will become the only high-end alternative to TSMC (TSM) on U.S. soil. That potential, which involves de-risking supply chains while riding the AI and custom silicon wave, underpins the bull case. Analysts have been blunt that Intel’s foundry future “depends on securing a customer” for next-gen nodes. Still, the Microsoft commitment, the AMD chatter, and the government/Nvidia/SoftBank capital stack collectively raise the odds that those dominoes fall Intel’s way.

There’s also a powerful “policy put” underneath the shares now. Washington’s equity stake isn’t a free pass on execution, but it reduces tail risk associated with financing multibillion-dollar fabs and signals that key U.S. customers will at least consider Intel for advanced designs. When you also consider the AI-PC refresh cycles (where Intel still holds a significant market share) and the prospect of co-developed products with Nvidia, you can see how the narrative has shifted from whether Intel can survive to how Intel can take advantage.

Does The Valuation Reflect The Underlying Risks?

Following Intel’s strong rally — and acknowledging that some of the recent momentum reflects hype as well as hope — valuing the stock isn’t straightforward. Consensus EPS estimates call for just $0.12 in 2025, rising to $0.63 in 2026, $1.15 in 2027, and $2.16–$2.65 by 2028–2029.

On those depressed 2025 earnings, the forward P/E of ~300x looks excessive. However, 2025 should be viewed as a transition year, weighed down by foundry ramp-up costs, underutilized fabs, and the tail end of the PC downcycle. If earnings ramp as expected into the out-years, the valuation picture improves quickly — roughly 58x in 2026, 32x in 2027, 17x in 2028, and 14x in 2029. A lot can happen in the next four years, although for the time being, INTC stock is well-positioned in relation to its peers. INTC’s EV/sales ratio is 3.97 compared to a sector median of 3.7.

To be clear, estimates can and will move. Still, a path like that reframes valuation from “expensive forever” to “expensive until fabs fill.” The market is handicapping a scenario where Intel wins enough foundry share (plus AI-PC uplift) to drive operating leverage, which is precisely why the equity injections and customer signals mattered so much.

Of course, there are significant risks. Technologically, 18A must hit the yield and performance targets. There are concerns around delays and the need for marquee customers, and any slippage would hit both Intel’s margins and credibility. Then, commercially, those AMD talks may lead nowhere. Geopolitically, Intel itself cautioned that a U.S. government stake could provoke backlash in key overseas markets, anything from license scrutiny to customer hesitancy. And while Nvidia’s and SoftBank’s investments are supportive, they don’t guarantee durable demand for Intel’s nodes. Everything will ultimately come down to execution.

Is Intel Stock a Buy, Sell, or Hold?

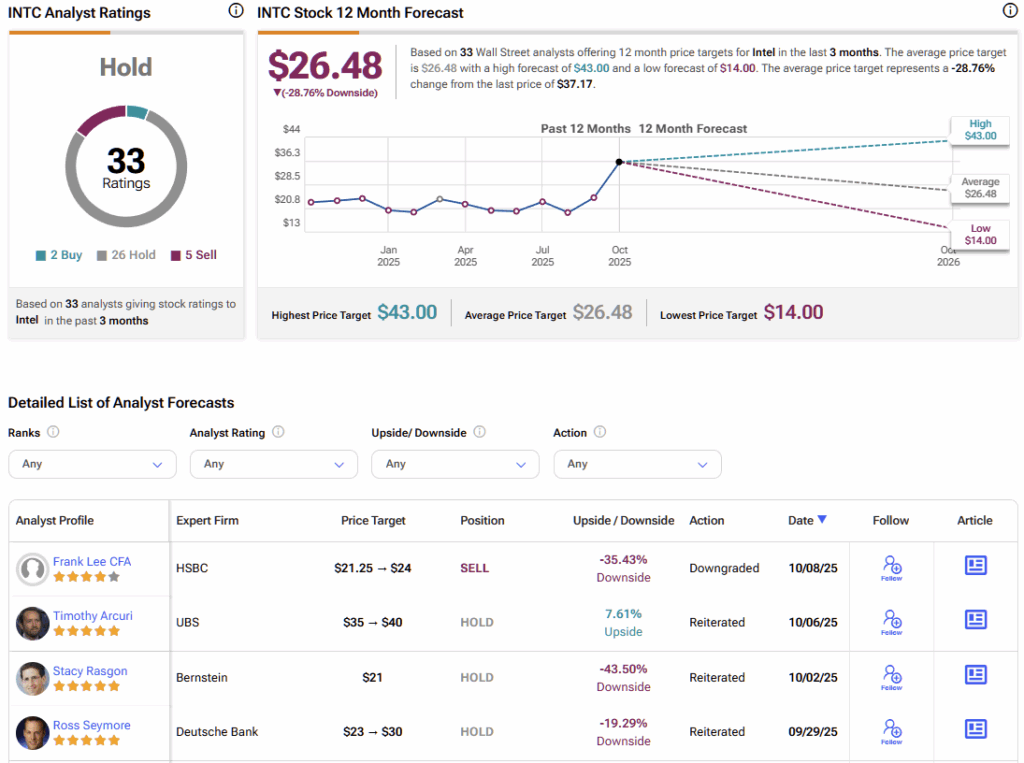

Wall Street remains somewhat skeptical of Intel at its current levels, which is understandable given the rapid surge in the stock’s price. Additionally, several analysts remain apprehensive about moving from neutral to bullish, considering the broader factors INTC is facing.

The stock is now carrying a Hold consensus rating based on two Buy, 26 Hold, and five Sell ratings. Notably, INTC’s average stock price target of $26.48 implies ~28% downside from today’s levels, which shows most analysts believe the stock has run ahead of itself.

Intel Hype Slowly Being Supported by Price Catalysts

Intel’s stock didn’t almost double this year by accident or because of a speculative run-up. Several key factors have arrived over the past three months to turn the dial on INTC. You have government ownership, Nvidia and SoftBank money, Microsoft as an 18A customer, and even whispers of AMD business have yanked INTC’s woeful narrative out of the mud.

If — and it’s still a meaningful if — Intel can convert that momentum into signed, scaled wafer starts, today’s stretched near-term P/E could normalize by 2027. I remain Bullish because the asymmetric setup finally tilts in Intel’s favor, but I’m watching execution — and potential international backlash over the government stake — closely.