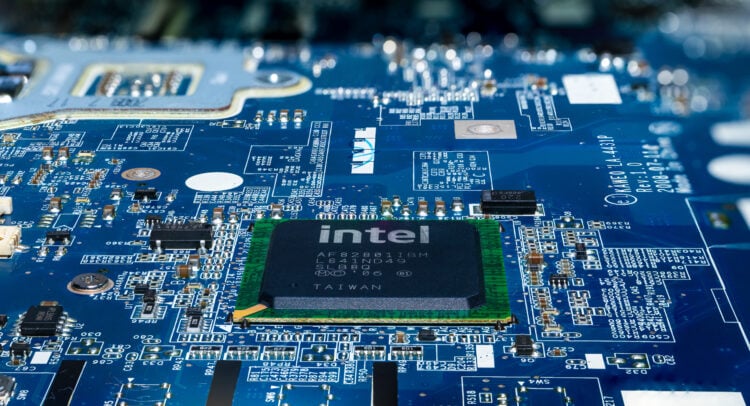

It was a terrific day for chip stock Intel (INTC), and a development that investors have likely been dying to see for the last few weeks now. But Intel had a couple of potentially exciting new projects hiding out, and their recent emergence left investors looking downright giddy for a while there. Intel shares were up nearly 5% in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One of the first exciting bits of news out of Intel today was the revelation that Intel might be working on its own “multi-frame generation” technology. This comes at a very interesting and potentially awkward time, as such a technology would put it in direct competition with Nvidia (NVDA), which just bought in on Intel, and quite heavily.

The report derived information from graphics driver files located in Arc systems, and included XeSS multi-frame generation name and logos therein. With MFG, the system generates frames as normal, but also inserts an AI-generated frame between two actual frames. This works to counteract one of the key issues of AI-generated artwork: the fact that it does not look real. Considering that we are talking here about frames that might appear in a display running at 120 Hz—or 120 frames per second—the odds that the AI will slip into the Uncanny Valley, or that viewers would notice something wildly out of whack, is minimal.

Banking Support

Then, Intel got involved in a project with Trust Stamp (IDAI) to potentially have some impact on banking security. The duo released a Partnership Brief that describes how Trust Stamp’s “…privacy-first, real-time identity verification using AI-optimized biometrics” might work.

Basically, using Trust Stamp’s systems and Intel’s Xeon Scalable Processors, the end result allows for what reports called “…real-time identity matching with high-throughput and low latency at scale, with deployment capability across cloud, edge and hybrid infrastructures.” This means better identity checking and a reduced potential for fraud down the line, once it is all put into place.

Is Intel a Buy, Hold or Sell?

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 25 Holds and five Sells assigned in the past three months, as indicated by the graphic below. After a 24.64% rally in its share price over the past year, the average INTC price target of $26.03 per share implies 15.46% downside risk.