The headline alone has likely prompted at least one spit take. So go ahead, wipe your monitor, and then I will tell you about how chip stock Intel (INTC) is planning to buy a company. Yes, this is the same Intel that has been cutting fat so hard for the last year that chunks of bone are starting to fly around. And it is clear investors were not pleased. Intel shares dropped fractionally in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Intel, which has made cutting budgets an art form so particularly hard-core that it briefly cut budgets for free coffee, is in talks to buy SambaNova Systems, an artificial intelligence (AI) chip startup. SambaNova has already been working with bankers to get a sense of the market’s interest, and Intel is making a play.

Reports suggest that any deal will actually be SambaNova selling at less than the $5 billion it was valued at in a funding round staged back in 2021. As to why Intel would want SambaNova, it turns out that SambaNova makes a line of AI chips that would be competitive with Nvidia’s (NVDA). Further, new CEO Lip-Bu Tan even has a personal connection to SambaNova; he has been SambaNova’s executive chairman since May 2024, reports note.

More About the Battlemage

Meanwhile, the idea that Intel has given up on the Battlemage discrete graphics processing unit (GPU) has run into another roadblock. Reports note that several potential versions of the processor will be coming out, based on the graphics driver’s INF file.

The file revealed that the BMG-G31 chip would be used in three different pro models as well as a single consumer version. This in turn suggests that there will be an Arc B770 after all, especially when coupled with earlier reports about the GPU using 16 gigabytes of VRAM. Better yet, if all the reports bear fruit, Intel will ultimately have a faster GPU than the Arc B580, and could be out sometime next year.

Is Intel a Buy, Hold or Sell?

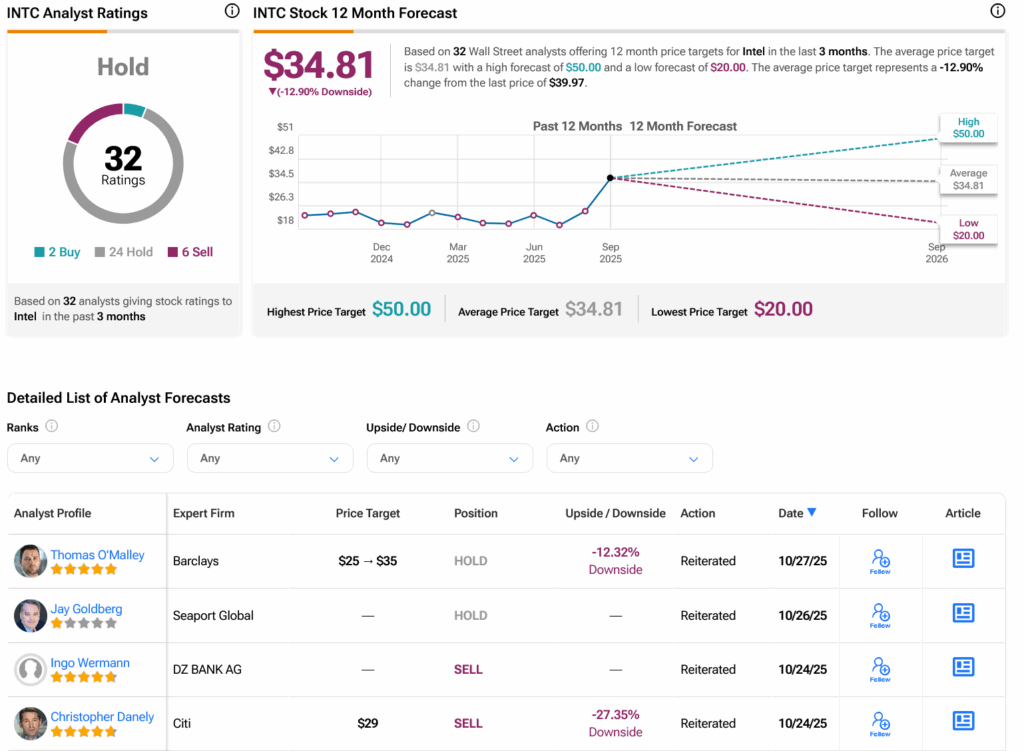

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 24 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 73.1% rally in its share price over the past year, the average INTC price target of $34.81 per share implies 12.9% downside risk.