File this under “all dressed up with no place to go.” Chip stock Intel (INTC) has been working to set up a new factory in New Albany, Ohio for quite some time now. The factory itself has encountered several delays, but one part of it apparently went through so rapidly that it is ready to go…but has nothing to do. Yet, anyway. The news left Intel—and power company AEP—with a bit of egg on its face, but investors took it in stride and gave Intel a fractional boost in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reports note that AEP put together a power substation to ensure that the new factory would have the power it needs to operate. But because Intel has delayed the project, there will be no power needed until the factory actually fires up in earnest. That means that AEP cannot start recovering its costs from the new factory substation, and is turning to state lawmakers for help.

The reports also noted that AEP wants the state to allow it to charge Intel directly for any costs that result from the delay. Both AEP and Intel reportedly turned to the Public Utilities Commission of Ohio to allow them to modify an agreement that was approved by the agency last year. With that approval—basically regarded as a “formality”—AEP would have “accounting authority” sufficient to extend the agreement itself.

A Brighter Outlook to Come

Meanwhile, recent analysis is calling particular attention to new CEO Lip-Bu Tan’s impact on the company. Intel’s recent spate of cost-cutting, done mainly at Tan’s instigation, and recent moves to pull in more cash, like the majority stake sale of Altera, have delivered excellent results. But these moves have somewhat limited impact, especially if something cannot be done to address the decline in market share that Intel has seen of late.

But with Intel bringing out fresh new products, like a pair of graphics processing units (GPUs) that should give it a fighting chance against even the likes of Nvidia (NVDA), and some new central processing units (CPUs) like the Core 9 270H, Intel has a much better chance of doing well going forward. The biggest problem for Intel right now, the report noted, seems to be simple public perception that Intel is moribund, hidebound, and going nowhere fast. The available information seems to contradict that assessment, despite Intel trading largely flat for the last several months.

Is Intel a Buy, Hold or Sell?

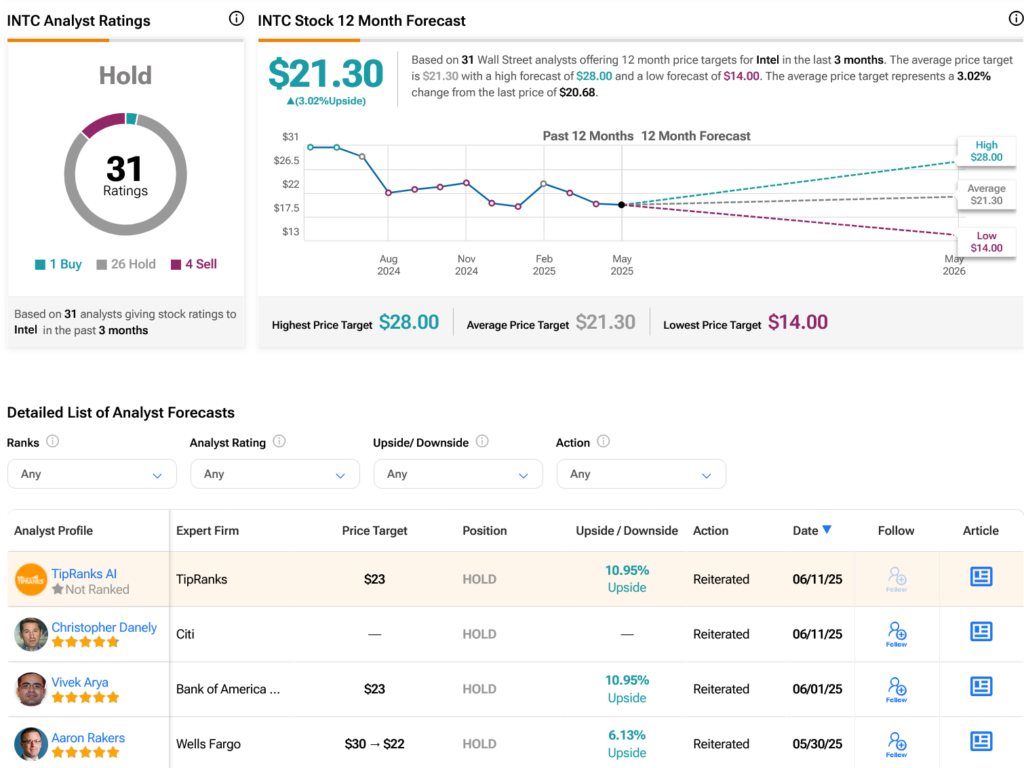

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 26 Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 32.11% loss in its share price over the past year, the average INTC price target of $21.30 per share implies 3.02% upside potential.