Narratives on Wall Street can change in the blink of an eye, and boy, Intel (NASDAQ:INTC) reflects such a shift. Once considered a big AI loser amidst a host of ongoing issues, INTC shares have jumped over 40% since news broke last week that Nvidia and Intel had formed a major partnership to jointly develop several future generations of custom products for data centers and personal computing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For now, the arrangement looks focused strictly on product collaboration, aiming to combine Nvidia’s accelerated computing and AI software stack with Intel’s x86 CPU platform, while also making use of NVIDIA’s NVLink interconnect technology.

Saying the market liked the idea is a bit of an understatement – a reaction Stifel analyst Ruben Roy says is justified.

“We view the collaboration positively for both Intel and NVIDIA as it brings together Intel’s long-standing expertise with the x86 compute architecture with NVIDIA’s GPU leadership,” Roy, who ranks amongst the top 1% of Street stock experts, said. “We believe that the primary value for Intel lies in the ability to directly participate in higher-density rack-scale AI infrastructure, which has been lacking for the company.”

Intel will be taking on two key roles: first, designing and producing custom x86 CPUs for Nvidia’s AI infrastructure platforms, effectively making Nvidia a CPU customer for rack-scale servers; and second, developing x86 system-on-chips that integrate Nvidia RTX GPU chiplets for PCs, positioning Nvidia as a GPU chiplet supplier in this segment. Alongside the collaboration, Nvidia also disclosed plans to invest $5 billion in Intel common stock at $23.28 per share, subject to regulatory approval.

It’s clear how Intel benefits from being closely associated with the biggest name in AI and the world’s most valuable company, but what’s in it for Nvidia? Roy says the $5 billion investment in Intel is a strategic effort to ensure long-term access to advanced x86 CPU manufacturing and packaging, particularly as AI workloads increasingly require close CPU-GPU integration. The stake represents more than a financial commitment – it is an infrastructural one – with talks of collaboration reportedly beginning on the very first day of Lip-Bu Tan’s tenure as CEO.

“By embedding itself deeper into Intel’s roadmap (and vice-versa), NVIDIA ensures alignment on future product cycles, packaging innovations, and ecosystem compatibility,” Roy noted.

But while Roy is “positive on the prospects of this announcement and capital infusion,” he does stress that there is “little change” to his thinking of Intel’s Foundry following the announcement.

During their joint webcast, Nvidia and Intel indicated that TSMC is expected to continue as the primary manufacturer for high-end GPUs and CPUs for the near future. It appears that Intel will initially need to prove itself on the 14A process and deliver strong performance on the product side before Nvidia would consider any commitment to diversifying its supply chain beyond TSMC.

“For Intel,” the 5-star analyst summed up, “we view the collaboration with NVIDIA as yet another in a string of recent catalysts to the company’s multi-year recovery story, not because it improves Foundry performance, but because it helps reassure investors that product sales should rise and that there is now a longer-tailed potential to see NVIDIA as a Foundry customer, should execution deliver.”

For now, then, Roy assigns Intel shares a Hold (i.e., Neutral) rating, backed by a $24.5 price target. Following the recent surge, that figure implies a 30% downside from current levels. (To watch Roy’s track record, click here)

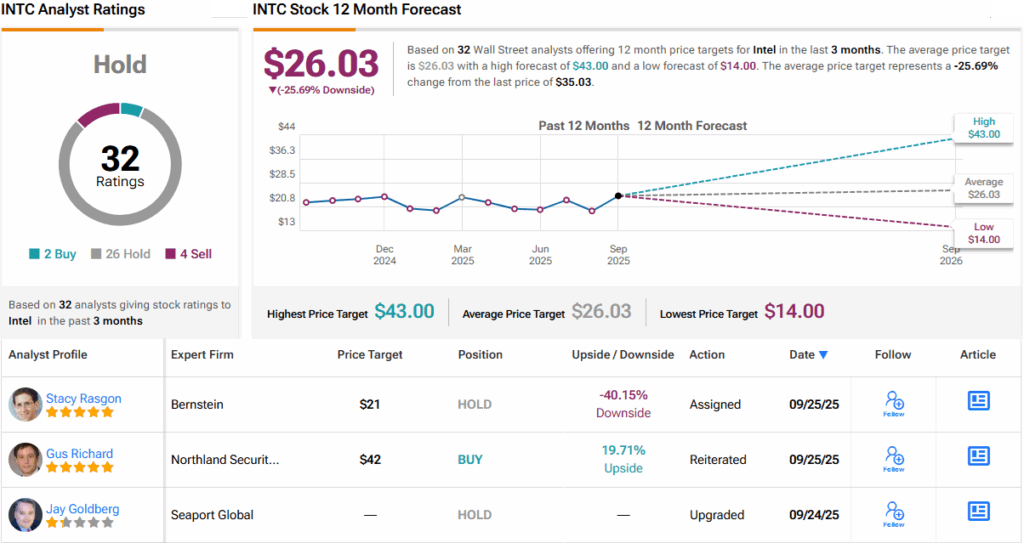

That cautious stance is echoed broadly across Wall Street. Barring 2 Buys and 4 Sells, all 26 other recent reviews also see the stock as a Hold, naturally making the consensus view a Hold too. At $26.03, the average price target factors in a one-year slide of ~26%. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.