Intel (NASDAQ:INTC) stock has battled well-documented struggles in recent years, but the company’s Q3 results suggest its turnaround efforts are finally starting to bear fruit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That is the opinion of Benchmark’s Cody Acree, an analyst ranked among the top 1% on Wall Street, who says that against a strong AI-driven server and PC computing backdrop – supported by healthy industry inventories and the ongoing Windows 11 refresh – Intel showed “solid progress in its cost structure and financial picture.”

The company also benefited from substantial cash inflows from the US government, Nvidia, SoftBank, and the asset sales of Altera and Mobileye, alongside growing confidence in yields and external customer activity in its foundry business. As such, Acree believes the earnings report provided investors with plenty of reasons for optimism.

The “standout” performer remained the PC business, with Client revenue reaching $8.5 billion – up 8% sequentially and 5% year-over-year – above the company’s expectations. This was driven by a seasonally stronger TAM (total addressable market), the Windows 11 refresh, a favorable pricing mix, and the ramp-up of both Arrow Lake and Lunar Lake. Intel anticipates its Client consumption TAM will reach roughly 290 million units in 2025, representing the second consecutive year of growth since the post-COVID “pull-in driven bottom” in 2023. This would represent the fastest industry TAM growth since 2021, with another strong year expected in 2026 as Core Ultra 3 and Panther Lake enter a “continued healthy” PC market.

While Intel still lags AMD significantly in the competitiveness of its Data Center server offerings, addressing this is a “corrective priority” for CEO Lip-Bu Tan. In the near term, Data Center revenue appears more constrained by Intel’s own supply limits than by current industry market share dynamics. Looking ahead, with the division now led by someone whose experience spans transistors, SOCs, and full systems, Acree expects Intel’s competitive position in the Data Center market to improve, boosted by the mid-2026 ramp of Clearwater Forest on Intel’s new 18A process, followed by Diamond Rapids and Coral Rapids.

Perhaps “most encouraging” was Intel’s increasingly confident outlook on its Foundry business, particularly the progress in both 18A and 14A processes. Lip-Bu Tan was “feeling much better” regarding 18A yields compared with just 90 days ago, and with 18A recently reaching volume production in Arizona, Intel is on track to record its first Panther Lake revenue in the notebook market before the year is out, while Clearwater Forest for servers is slated to ramp next year.

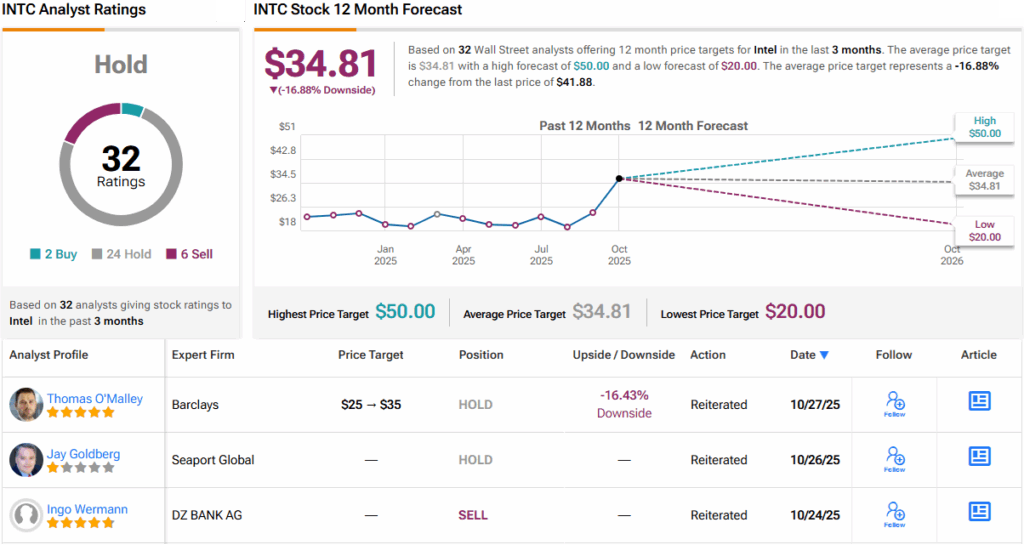

Expecting the “current positive momentum to continue through at least 2026,” and citing “improved confidence in the company’s turnaround and its long-term earnings ability,” the 5-star analyst assigns Intel shares a Buy rating, while raising his price target from $43 to a Street-high of $50. Should the figure be met, investors will be pocketing returns of 19% a year from now. (To watch Acree’s track record, click here)

That’s a bull’s take, although it is a minority stance on Wall Street right now. With an additional 1 Buy, 24 Holds and 6 Sells, the stock receives a lukewarm Hold (i.e., Neutral) consensus rating. The forecast calls for a 12-month loss of ~17%, considering the average target stands at $34.81. (See INTC stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.