Recently, chip stock Intel (NASDAQ:INTC) had a bit of trouble with some of its high-end processors, particularly those that were used for video gaming. Intel offered up a new explanation for the cause, but investors didn’t seem particularly enthusiastic as it involved spreading blame and pointing fingers. Shares were down modestly in Monday afternoon’s trading session after Intel rolled out a report about its processor crashes, and it pointed the finger squarely at motherboard makers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While some of those motherboard makers rolled out some BIOS updates to address the issue—in some cases costing system performance—Intel is begging to differ. An internal report revealed that Intel blames the BIOS settings themselves for the problem.

In particular, Intel blames BIOS settings that “…disable thermal and power delivery safeguards designed to limit processor exposure to sustained periods of high voltage and frequency.” Intel notes that it has processes built into its processors, like Thermal Velocity Boost and Current Exclusion Protection. But some motherboards aren’t taking these into account, and this is costing stability accordingly.

The Upcoming Arrow Lake Processor Line

Intel also let slip a bit of information about the upcoming Arrow Lake processor line. The reports suggest that, at launch, the CPUs will come in either 16+8 core or 6+8 core options. These processors are completely new, using an LGA 1851 socket for the first time ever. This isn’t official Intel information, so take it with the grain of salt you believe appropriate. But if this does bear out, the processors should have a good range of use cases and provide solid utility for users. That may make them attractive, particularly in a slumping economy where purchases need to count for more.

Is Intel a Buy, Sell, or Hold?

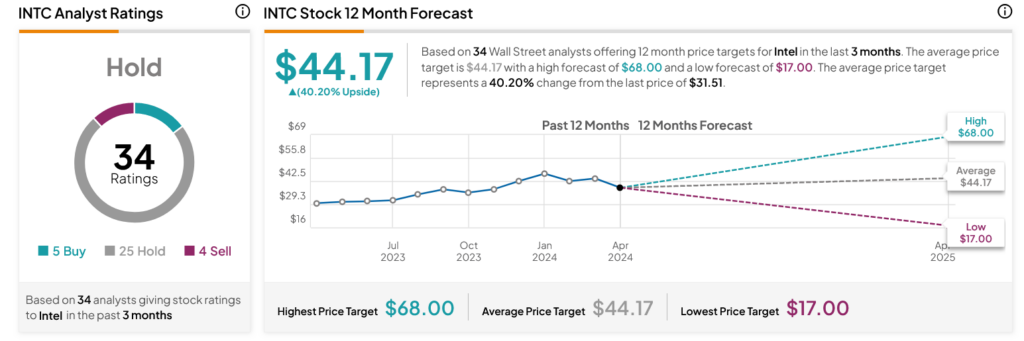

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on five Buys, 25 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 5.15% rally in its share price over the past year, the average INTC price target of $44.17 per share implies 40.2% upside potential.

Is INTC the Right Stock to Buy for Passive Income?

Before you hurry to invest in INTC, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and Intel is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.

Get a FREE sample of dividend stock insights! >>