Chip stock Intel (NASDAQ:INTC) had a lot to show off at its innovation event today. But sadly, what it had to show off was largely insufficient, as far as its investors were concerned. Intel slipped nearly 2% in Tuesday afternoon’s trading, and the panoply of new chips it had to show off didn’t make much difference at all.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

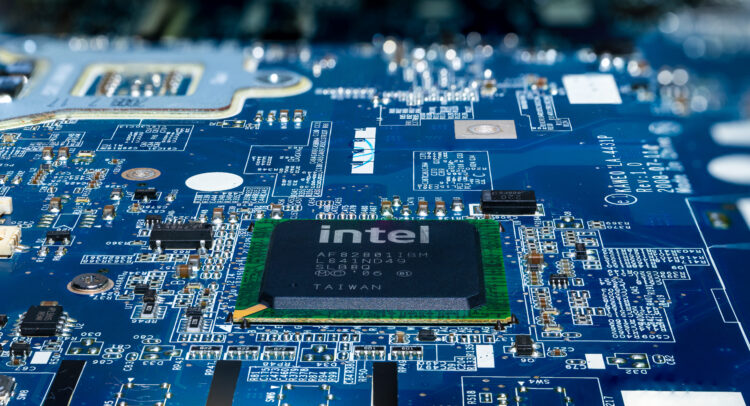

Intel brought its A-game to its latest innovation show, showing off new Xeon processors that boast improvements in overall efficiency and performance. An E-core processor coming soon would feature a whopping 288 cores in its operation, and the word from Supermicro Computer (NASDAQ:SMCI) noted that its x13 server line would feature early access to the new Xeon processors. When the Core Ultra processors come out, meanwhile, that will allow for “power efficient” AI systems, which means access to AI functions through the PC as well.

What’s more, some new products actually leaked ahead of launch weren’t part of the innovation show. The Intel Core i5-14600K processor’s specifications got the leak treatment ahead of launch, and what it had to reveal was pretty impressive. The Core i5 in question will boast 14 cores and 20 threads, offering a notable performance increase against the previous generation. Among other things, it offers an 8% improvement in single-core operation. Multi-core performance, meanwhile, got a 14% hike.

What is the Stock Prediction for Intel?

Analysts, meanwhile, are largely staying out of Intel. With six Buy ratings and six Sell ratings matching up against 21 Holds, it’s clear why the analyst consensus calls Intel stock a Hold. Further, with an average price target of $36.19, Intel stock offers its investors 2.87% downside risk.