Intel Corp. (NASDAQ:INTC) is planning to downsize its workforce by the end of October, according to a late-Tuesday report by Bloomberg. The report underscores the difficulties that the semiconductor industry is facing on the back of supply shortages, trade restrictions, elevated costs, and high interest rates that are severely affecting investments.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Intel, which currently has around 121,000 employees all over the world, is likely to announce the layoff during its third-quarter earnings announcement on October 27. The reported downsizing plan puts the jobs of thousands of worldwide Intel workers at stake. It is said that the sales and marketing departments could be reduced by 20%. However, no geographic specifications were mentioned in the report.

The responsibility of bringing Intel back to its leadership position in chip manufacturing has been on CEO Pat Gelsinger’s shoulders since last year, when the semiconductor industry was beginning to feel the force of the headwinds. And now that the macro, as well as industry-specific headwinds, have aggravated and led to a drop in PC demand, Gelsinger is being forced to make difficult decisions to help Intel’s crashing margins and profitability.

In separate news, Gelsinger is also focusing on segregating Intel’s chip designing and chip-making operations in an effort to restructure the company and enhance returns.

What is Intel’s Stock Prediction?

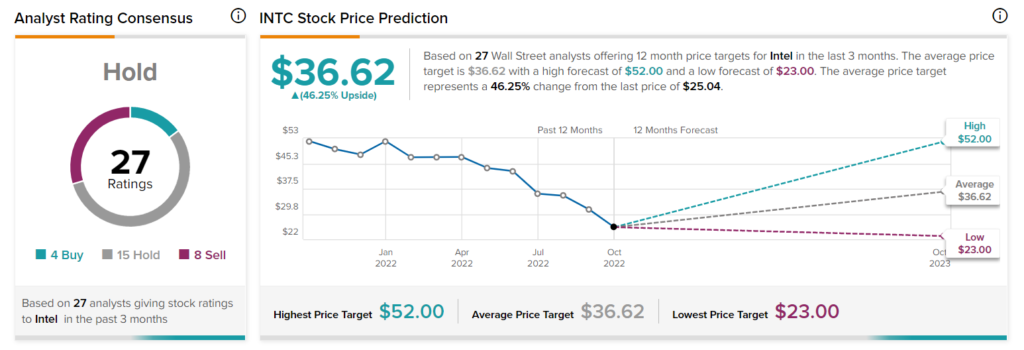

Wall Street analysts are cautious about INTC stock, with a Hold consensus rating based on four Buys, 15 Holds, and eight Sells. The average price target for Intel stock is $36.62, which indicates 46.3% upside potential to price.