Chip giant Intel (NASDAQ:INTC) could scrap its proposed acquisition of Tower Semiconductor (NASDAQ:TSEM) since it is unlikely to receive Chinese regulatory approval in time, Bloomberg reported. Per the report, the deadline for securing regulatory approval falls at midnight on August 15, California time.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To give some background, Intel announced its intention to acquire Tower Semiconductor, an Israel-based integrated circuit manufacturer, for $5.4 billion in February 2022. Subsequently, in May 2023, the company engaged in discussions with Chinese regulatory authorities to win approval for the acquisition.

The acquisition of Tower Semiconductor would have positioned Intel as a significant provider of foundry services. Intel CEO Pat Gelsinger said during the announcement of the deal that the TSEM’s global reach, specialty technology portfolio, and services-first operations will expand INTC’s foundry services and enable it to become a “major provider of foundry capacity globally.”

Getting Chinese approval is tough for Intel as the ongoing U.S.-China chip war continues to create challenges for semiconductor companies. Washington has restricted semiconductor exports to China. Meanwhile, China imposed a ban on the use of Micron’s (NASDAQ:MU) chips by its key infrastructure operators.

In a note dated May 22, Robert W. Baird analyst Tristan Gerra warned that the chip war between the U.S. and China would hurt more companies in the semiconductor sector. Against this backdrop, let’s look at what the Street recommends for INTC stock.

Is Intel a Buy, Sell, or Hold?

The company established Intel Foundry Services in March 2021 to become a significant player in the foundry market, which is dominated by Taiwan Semiconductor (NYSE:TSM). Nevertheless, if the Tower Semiconductor acquisition falls through, it could lead to disappointment among investors and slow Intel’s progress in establishing itself as a prominent player in the field of foundry services.

Further, the company has been losing market share to competitors. Also, challenges in the Data Center segment remain a drag for the company.

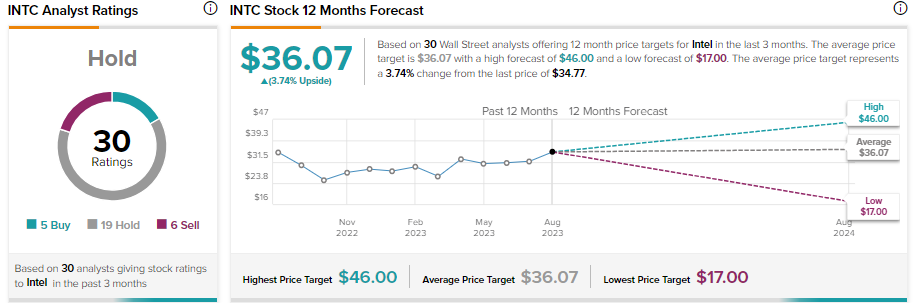

All of these are bad news for Intel shareholders, who witnessed a recovery in INTC stock this year. Given these challenges and opportunities related to AI (artificial intelligence), analysts are neither bullish nor bearish. With five Buy, 19 Hold, and six Sell recommendations, Intel stock carries a Hold consensus rating on TipRanks. Analysts’ average price target of $36.07 implies a limited upside potential of 3.74% from current levels.