Shares of Intel (NASDAQ:INTC) hit a new 52-week high today after Mizuho Securities upgraded the stock. Analyst Vijay Rakesh foresees positive trends in the PC and data center markets. As a result, he elevated Intel’s status from Hold to Buy while increasing the price target from $37 to $50 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This upgrade is based on expectations of Intel introducing new server products and securing a foundry customer within the next six months. Rakesh notes that Intel’s 2024 product roadmap for computing and data centers appears more promising than its competitors and marks an improvement over Intel’s past performance.

The anticipated upcycle in the PC and data center markets by 2024 also contributes to this optimistic outlook. Furthermore, Rakesh points out the potential value addition from the forthcoming split of Intel’s Programmable Solutions Group, which could contribute an additional $17 per share.

Looking ahead to 2025, which is expected to be a pivotal year for Intel’s foundry services business, Rakesh suggests that Intel’s shares could have an implied sum-of-the-parts valuation of approximately $84 per share.

What is the Target Price for Intel Stock?

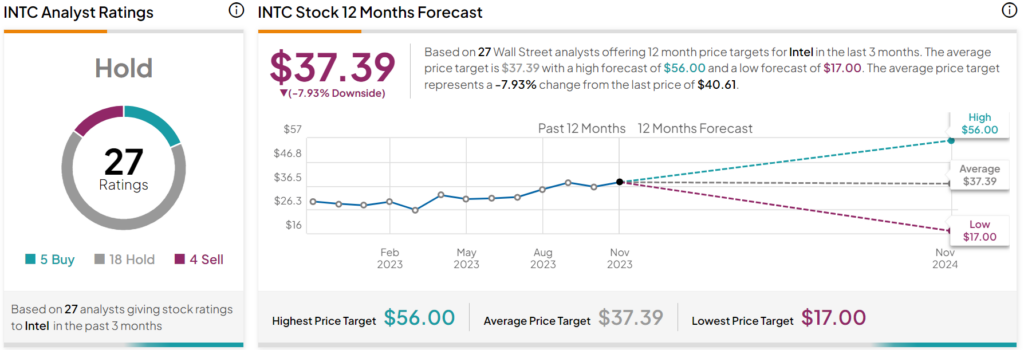

Overall, analysts have a Hold consensus rating on INTC stock based on five Buys, 18 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 40% rally in its share price over the past year, the average INTC price target of $37.39 per share implies almost 8% downside risk.