Semiconductor giant Intel (NASDAQ:INTC) has bagged a $3.2 billion grant for its planned mega chip facility in Israel. The $25 billion plant is expected to be the biggest investment by a company in Israel ever, according to Reuters.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Intel already has four facilities in Israel. The planned expansion at its Kiryat Gat site is part of Intel’s series of moves to set up a resilient supply chain globally. The company plans to invest nearly $100 billion in a chip complex in Ohio even as it expands its footprint in Europe. It is eyeing an investment of over $33 billion in multiple chip facilities in Germany. However, Intel could lose subsidies worth about 10 billion euros in Germany after an adverse court ruling on the country’s finances.

Meanwhile, Intel has committed to buying goods and services worth nearly $16.6 billion from Israeli suppliers over the next 10 years. The development comes at a time when Israel has been embroiled in a conflict with Hamas following the terrorist group’s unprovoked attack on the country on October 7.

What is the Target Price for Intel Stock?

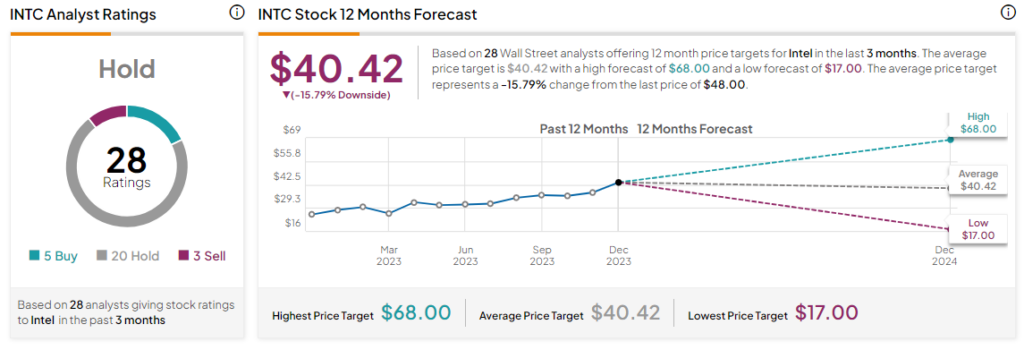

Overall, the Street has a Hold consensus rating on Intel, and the average INTC price target of $40.42 implies a potential downside of 15.8% in the stock. That’s after a massive 85% rally in the company’s share price over the past year.

Read full Disclosure