It’s been two trading sessions in a row now where Chewy (NYSE:CHWY) values have fallen, and this time, it’s for an all too familiar reason. Insiders are selling off shares of the online pet retailer and doing so in substantial numbers. That’s got investors spooked and running for the exits as Chewy stock fell over 5% in Monday afternoon’s trading.

Leading the charge down was most of the C-suite, as the CEO, Sumit Singh, sold off $3.5 million in shares on February 2. Meanwhile, interim CFO Stacy Bowman dropped $19,800 worth of stock, and CTO Satish Mehta sold $717,000 worth. The numbers haven’t been looking all that good either; back in 2022, Chewy had around 20.4 million active customers. Meanwhile, 2023 saw that number decline to 20.3 million. It’s not a huge loss, but it’s not the way anyone wants to see that sort of thing go.

Disturbing Signs Are on the Rise

Recently, there’s been little shortage of trouble for Chewy. It recently took a scolding from the Food and Drug Administration (FDA) over the sale of “unapproved and misbranded” drugs for pets. It wasn’t alone on that front—the FDA took several online pet supply operations to task over that one—but it wasn’t excluded. Further, there are some signs that Chewy could prove a major acquisition target, as retailers turn up the competition and consumers run out of gas.

Is Chewy Stock a Buy, Sell, or Hold?

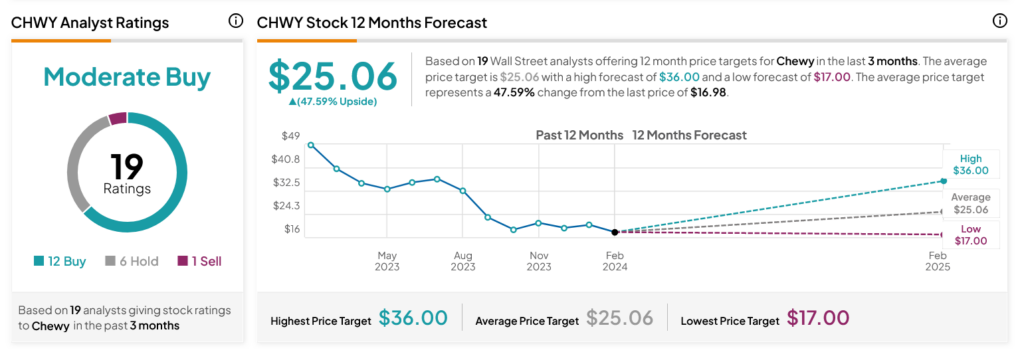

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CHWY stock based on 12 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 64.77% loss in its share price over the past year, the average CHWY price target of $25.06 per share implies 47.59% upside potential.