Philip O’ Doherty, Managing Director of E+1 Engineering, executive, and more than 10% owner of Vertiv Holdings Co. (NYSE:VRT), sold shares worth $252.97 million last week, reflecting caution on the company’s future potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vertiv Holdings develops and sells critical infrastructure technologies and rapidly deployable customized solutions to meet specific business requirements. Some of its main offerings include liquid cooling solutions for data centers, complete power management, and thermal solutions.

A Closer Look at the Insider’s Transactions

As per the Form 4 filed with the SEC on May 28, Doherty undertook multiple sales of 2,431,793 VRT shares on May 23 and 24, at weighted average prices ranging between $101.50 and $107.47 per piece. It is worth noting that after the latest Informative Sell transactions, Doherty now owns 6,892,388 Vertiv shares worth $731.76 million.

Vertiv Holdings stock currently has a Very Negative Insider Confidence Signal on TipRanks based on Informative Sell transactions undertaken in the last three months.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

What is the Price Target for Vertiv?

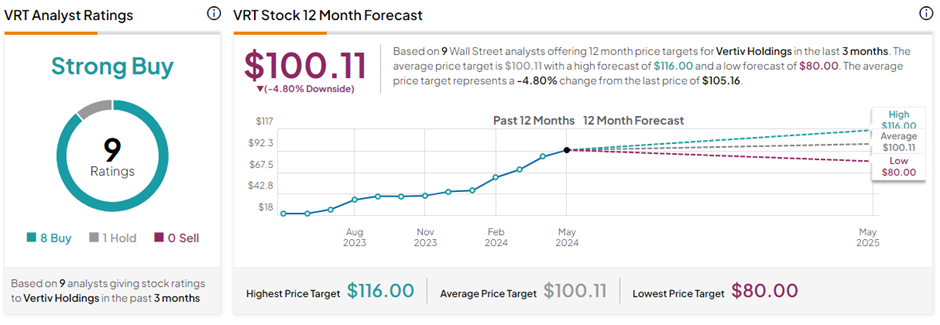

On TipRanks, the average Vertiv Holdings price target of $100.11 implies 4.8% downside potential from current levels. Interestingly, VRT stock has a Strong Buy consensus rating on TipRanks, backed by eight Buys and one Hold rating. In the past year, VRT shares have zoomed over 422%, propelled by the high demand for AI (artificial intelligence) chips and state-of-the-art data centers.