One of Talos Energy’s (NYSE:TALO) more-than-10% owners, Control Empresarial de Capitales S.A. de C.V., revealed a huge purchase of the company’s shares, worth $14.3 million. It should be noted that Control Empresarial de Capitales S.A. de C.V. is an investment company. Following the news, TALO stock was up 1.5% in Friday’s extended trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Talos Energy is an independent oil and gas company focused on offshore exploration and production in the Gulf of Mexico.

As per the SEC filing, the insider bought 1.11 million shares of the company on March 13 and 14. Before this, the insider had purchased 19.66 million shares on January 17 for about $230 million. Further, it had bought Talos Energy stock worth $1.99 million and $21.7 million on November 13, 2023, and November 8, 2023, respectively.

Insider’s Purchase Follows 2024 Guidance Revision

Last week, Talos Energy raised its operational and financial outlook for 2024 to reflect the earlier-than-expected closing of the QuarterNorth Energy Inc. acquisition on March 4.

The company expects average daily production between 89 and 95 thousand barrels of oil equivalent per day (MBoe/d), up from the previous outlook of between 87 and 93 MBoe/d. Furthermore, cash operating expenses are expected between $510 million and $530 million, compared with the prior expectations of $505 million to $525 million.

Talos Energy’s near-term prospects look impressive, given an improved production outlook and the current high oil prices, exceeding $81 per barrel. Furthermore, the QuarterNorth deal is expected to strengthen the company’s footprint in the Gulf of Mexico.

Is TALO a Good Stock to Buy?

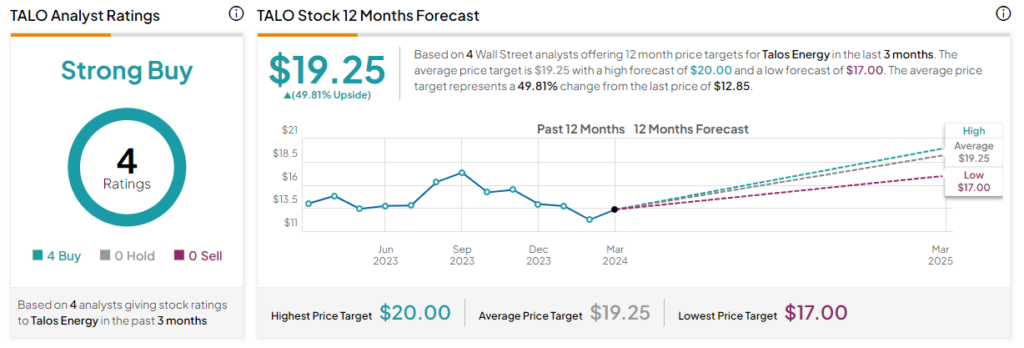

Overall, TALO stock has a Strong Buy consensus rating on TipRanks based on four unanimous Buy recommendations. The average price target of $19.25 implies a 49.81% upside potential. Shares of the company have declined 21.4% over the past six months.