Broadwood Partners L.P., a more than 10% owner of Staar Surgical (NASDAQ:STAA), has been on a buying spree of STAA stock over the past month. STAA stock gained more than 1% on Friday’s extended trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Staar Surgical manufactures and markets implantable lenses and delivery systems used in ophthalmic surgery.

In the latest transaction, Broadwood Partners purchased 205,296 shares in multiple transactions from October 4 to October 6, at an average price of $37.81 per share. The total purchase consideration stands at $7.76 million.

It is worth highlighting that Broadwood Partners’ most recent buy is its third purchase of STAA stock in the past month. The firm bought shares of the company worth $11.7 million and $7.9 million on September 21 and 7, respectively.

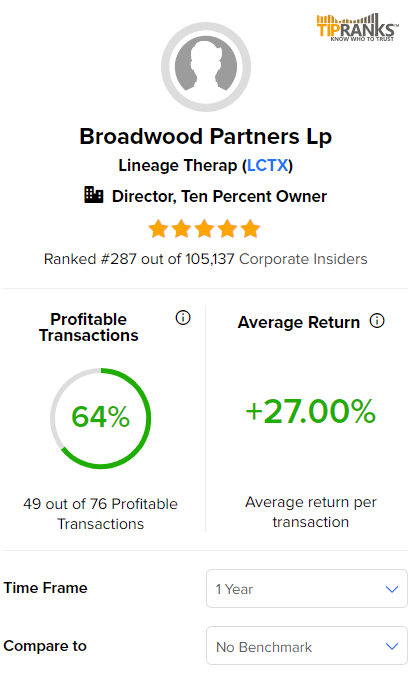

The total value of STAA stock in Broadwood Partners’ portfolio currently stands at $730.4 million. Interestingly, the hedge fund’s performance track record shows a 64% success rate over the past year, with an average return of 27% per transaction.

Bullish Insider Trading Signal

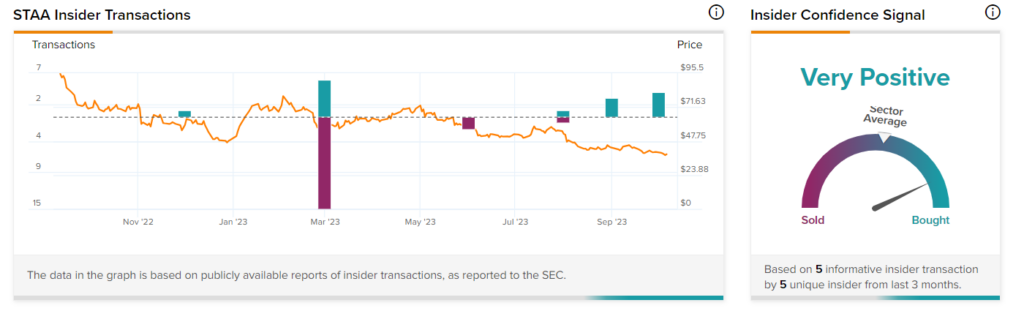

Overall, corporate insiders have bought Staar Surgical stock worth $27.5 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Staar is currently Very Positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is STAA a Good Stock to Buy?

Given the positive outlook from insiders, it seems reasonable to expect significant positive developments in the company’s future.

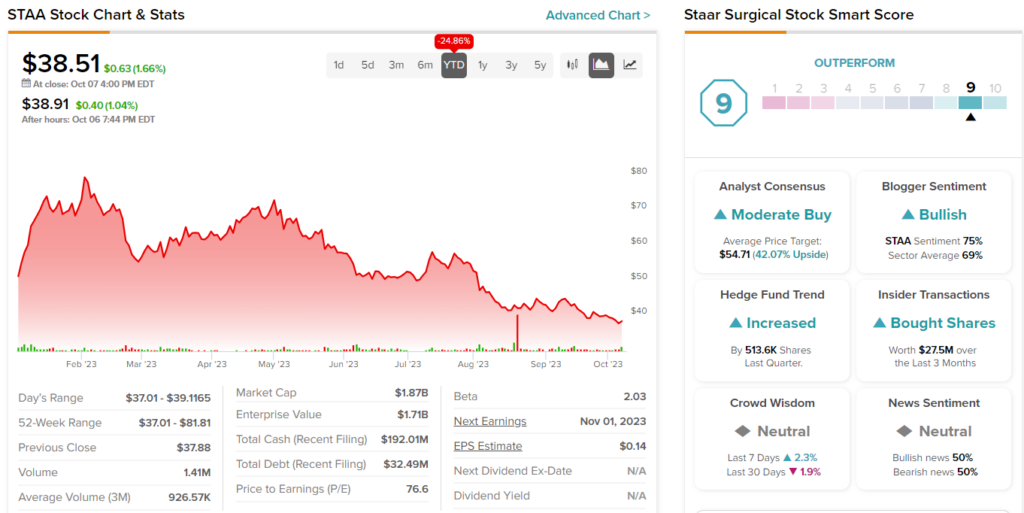

On TipRanks, STAA stock has a Moderate Buy consensus rating based on five Buys and five Holds. The average Staar Surgical stock price target of $54.71 implies 42.1% upside potential. The stock is down more than 24% so far in 2023.

Importantly, hedge funds increased their holdings of STAA stock by buying 513,600 shares in the last quarter. Furthermore, the stock has a TipRanks’ Smart Score of nine, indicating its potential to outperform market averages.