One of Staar Surgical’s (NASDAQ:STAA) more than 10% owners, Broadwood Partners L.P., has been showering STAA stock with love in the past few months. Broadwood Partners, a private investment firm, has bought STAA’s shares multiple times this year. Staar manufactures and markets implantable lenses and delivery systems used in ophthalmic surgery.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In the latest transaction, Broadwood Partners purchased 309,154 shares in multiple transactions from November 4 to November 6, at an average price of $34.92 per share. The total purchase consideration stands at $10.8 million.

It is worth highlighting that Broadwood Partners bought shares of the company worth $7.8 million last month. Before that, the firm bought stock worth $11.7 million and $7.9 million on September 21 and 7, respectively.

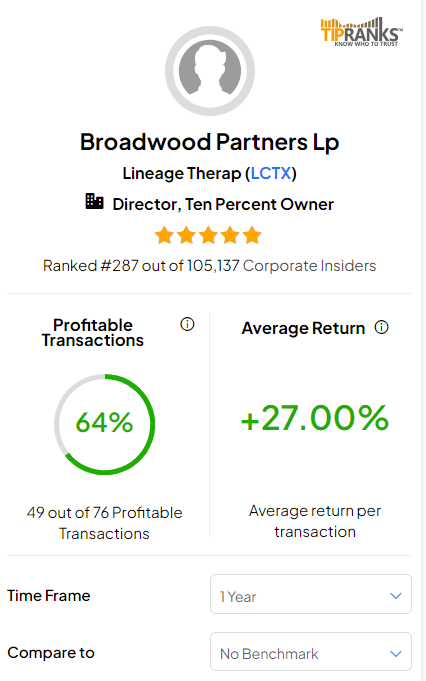

The total value of STAA stock in Broadwood Partners’ portfolio currently stands at $675.6 million. Interestingly, the firm’s performance track record shows a 64% success rate over the past year, with an impressive average return of 27% per transaction.

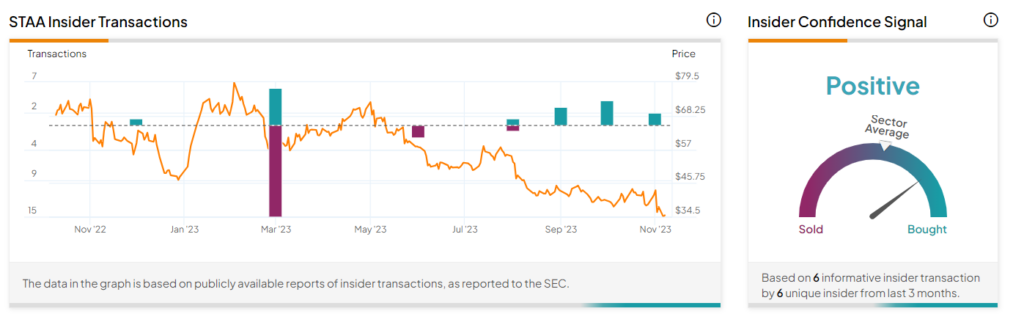

Bullish Insider Trading Signal

Overall, corporate insiders have bought Staar Surgical stock worth $38.3 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Staar is currently Positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Recent Updates

The insider’s purchase came after the company reported mixed third-quarter results on November 2. The main highlight of the quarterly report was STAA beating earnings expectations by a significantly wide margin. Following the earnings release, two analysts rated STAA stock a Buy, while one assigned a Hold.

Among the bullish analysts, David Saxon from Needham expects STAA to see double-digit growth with improved profitability over the long term.

Is STAA a Good Stock to Buy?

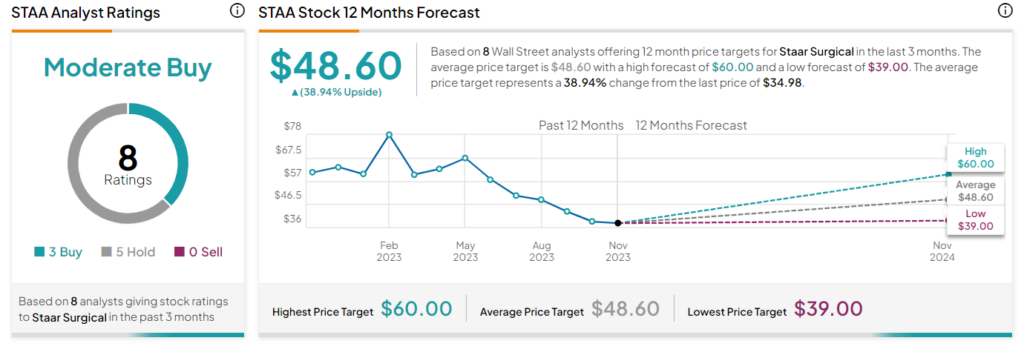

On TipRanks, STAA stock has a Moderate Buy consensus rating based on three Buys and five Holds. The average Staar Surgical stock price target of $48.60 implies 38.94% upside potential. The stock is down more than 31% so far in 2023.