David M. Maura, Director, Executive Chairman, and CEO of Spectrum Brands (NYSE:SPB), is optimistic about the company’s future as he recently purchased its shares. The global consumer products company specializes in supplying household appliances, hardware, and other consumer goods.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In the recent SEC filing, Maura disclosed buying 40,000 shares of the company in multiple transactions on November 27 and November 28, at a weighted average price of $66.72 per share. The transaction’s total consideration stands at $2.67 million.

It is worth highlighting that the CEO’s move is in sync with other key insiders of the company. Alongside Maura, Zargar Ehsan, SPB’s Executive Vice President and Corporate Secretary, disclosed the purchase of $70,025 worth of the company’s shares.

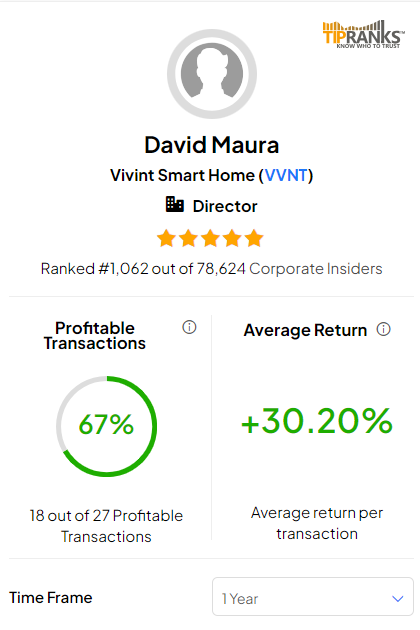

As per TipRanks’ data, Maura has had a success rate of 67% in his transactions over the past year. Also, he has been able to generate an average return of 30.2% per transaction.

Insider Confidence Signal

Corporate insiders have bought SPB shares worth $3.2 million over the last three months. Overall, TipRanks’ Insider Trading Activity Tool shows that insider confidence in Spectrum Brands is currently Positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is SPB Stock a Good Buy?

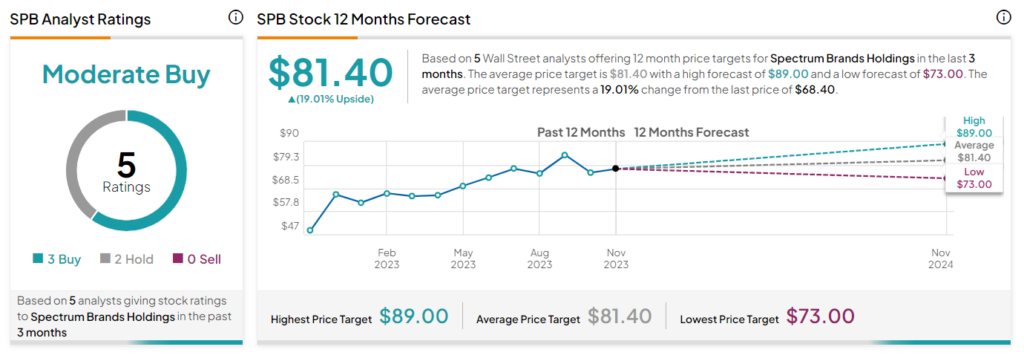

Investors should note that Spectrum Brands reported better-than-expected Q4 results on November 17. Following the earnings release, three analysts rated the stock a Buy, while two assigned a Hold. Based on these analyst ratings, SPB stock has a Moderate Buy consensus rating. The average stock price target of $81.40 implies 19% upside potential. The stock has gained 12.4% so far this year.